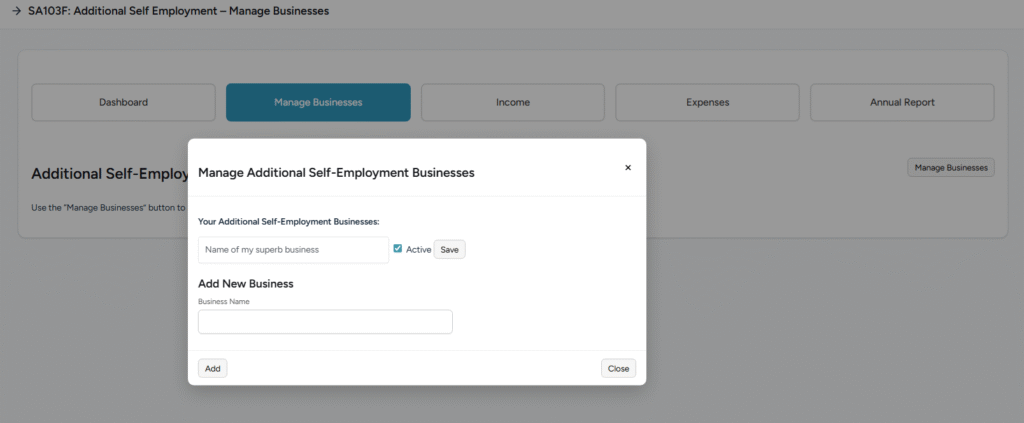

Getting Started: Manage Businesses Screen

Before you can track income and expenses, you need to add your additional self-employment businesses.

To add a new business:

- Navigate to the “Manage Businesses” page using the button menu

- Click the “Manage Businesses” button to open the management modal

- Scroll to “Add New Business” section at the bottom

- Enter your business name in the “Business Name” field

- Click “Add”

- Your business will appear in the list above

To edit a business:

- Open the “Manage Businesses” modal

- Find your business in the list

- Update the business name in the text field if needed

- Check/uncheck the “Active” checkbox to activate or deactivate

- Click “Save” next to that business

Important notes:

- Maximum of 5 additional self-employment businesses allowed

- Only active businesses appear in income/expenses dropdowns

- Businesses cannot be deleted (only deactivated) to preserve historical records

- Deactivating a business hides it from new entries but doesn’t affect existing records

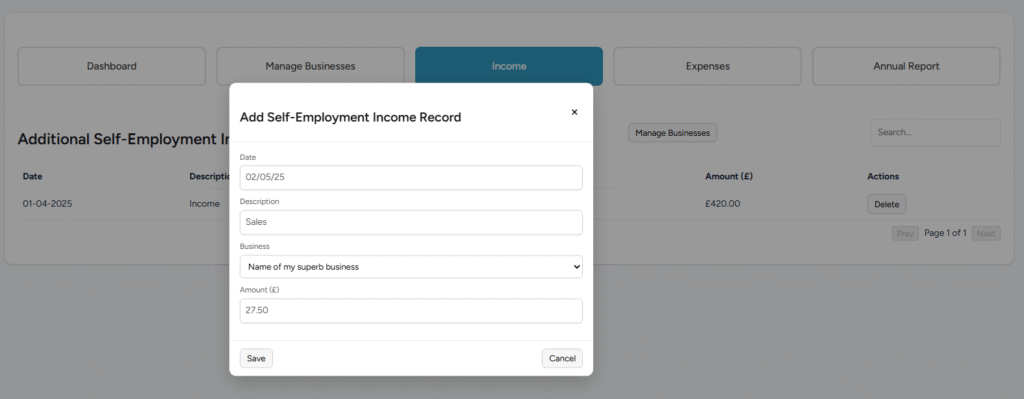

Recording Income

To add an income transaction:

- Click “Add new” button in the top right

- Fill in all required fields:

- Date: Enter as DD-MM-YYYY (e.g., 15-06-2025) or DD/MM/YY (e.g., 15/06/25)

- Description: Brief explanation of the income source

- Business: Select from dropdown (only active businesses shown)

- Amount (£): Enter in pounds and pence (e.g., 1500.00)

- Click “Save”

The income table shows:

- Date in DD-MM-YYYY format

- Description of the income

- Which business it relates to

- Amount in £ with 2 decimal places

- Actions column with “Delete” button

Managing income records:

- Search: Type in the search box to filter by description

- Pagination: Use “Prev” and “Next” buttons to navigate pages

- Delete: Archives the record (soft delete – can be restored by administrators)

- Sorting: Most recent transactions appear first

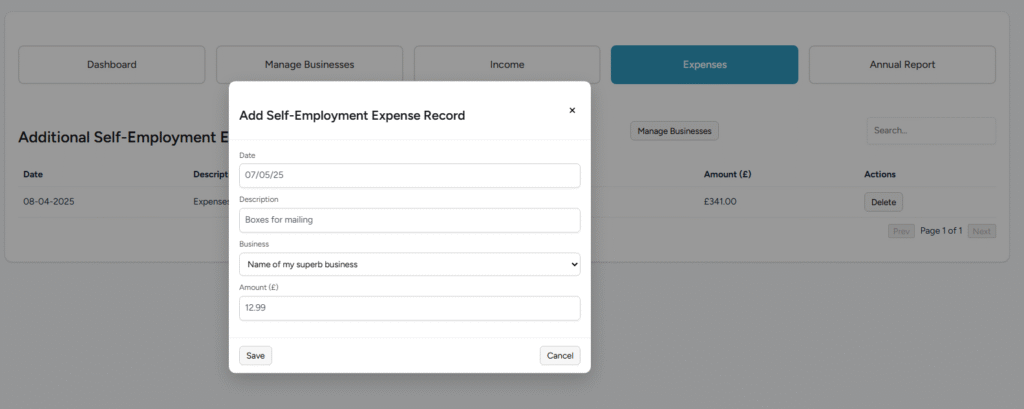

Recording Expenses

To add an expense transaction:

- Click “Add new” button in the top right

- Complete the required fields:

- Date: Enter as DD-MM-YYYY (e.g., 15-06-2025) or DD/MM/YY (e.g., 15/06/25)

- Description: What the expense was for

- Business: Select from dropdown (only active businesses shown)

- Amount (£): Enter in pounds and pence (e.g., 45.50)

- Click “Save”

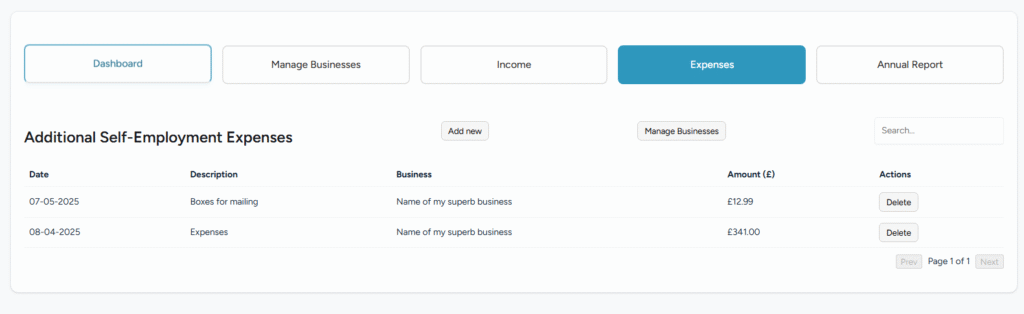

The expenses table shows:

- Date in DD-MM-YYYY format

- Description of the expense

- Which business it relates to

- Amount in £ with 2 decimal places

- Actions column with “Delete” button

Managing expense records:

- Search: Type in the search box to filter by description

- Pagination: Use “Prev” and “Next” buttons to navigate through records

- Delete: Archives the record (can be restored by administrators if needed)

- Sorting: Most recent expenses appear first

Viewing the Annual Report

The Annual Report provides a comprehensive overview of your additional self-employment performance for the relevant tax year.

What the report shows:

For each business (shown separately):

- Business name with status indicator (Active/Inactive)

- Monthly breakdown table with columns for each month (Apr 2025 – Mar 2026)

- Income row: Total income per month

- Expenses row: Total expenses per month

- Profit/Loss row: Calculated automatically (Income – Expenses)

- Total column: Year-to-date totals on the right

Overall Summary section:

- Combined totals across ALL businesses

- Total Income (all businesses combined)

- Total Expenses (all businesses combined)

- Overall Profit/Loss (highlighted in blue border)

- Color coding:

- Green background for income

- Red background for expenses

- Yellow background for profit/loss rows

- Red text for losses, green text for profits

How to use the report:

- Click “Annual Report” in the button menu

- Review each business’s performance individually

- Check the Overall Summary at the bottom for your combined position

- Use this information for tax planning and business decisions

- Print or save the page for your records