Business Income is defined as any income which is realised as a result of business activity.

In plain English, this is any money you receive for what you do.

Income as a Slimming World Consultant comes from several different sources – the below list provides main key common items.

Within your group

There are a number of ‘income sources’ within your group – here’s a few of the key ones:

Member Fees

Each week, members pay a fee to join or attend a Slimming World group. This is income as you are receiving payment for goods/services provided. The original amount which the member (or customer) pays is taken into consideration with this, therefore if the member has paid £10 to join, your income from this is £10 (do not reduce this figure based on your earning percentage, you need to take the full amount).

To calculate the total member fees recevied from your group, use the below calculation:

Nett Fees A + Retained Earnings + Rent Paid = Total Fees Taken

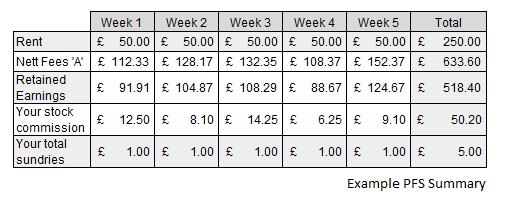

It is easy to find these figures from your monthly PFS Document which summarises the whole month for you, an example of this is shown below for a 5-week ‘Slimming World Month’.

From this example, using the numbers in week 1, you would calculate the group income (membership fees) from the using the calculation above.

The total would therefore be:

Week 1:

Nett Fees A + Retained Earnings + Rent Paid = Total Fees Taken

Therefore,

£112.33 + £91.91 + £50 = £254.24 Member fees income for this group

You can read more about how to interpret the other figures using the ‘completing your MalgraBooks Account Template‘ article – even if you’re not using our spreadsheets or software to run your accounts.

Sundries

Sundries (where you receive income from Slimming World) is another form of income. This could be from commission based on SWOR or Gift Vouchers.

Important: Some sundries (e.g. XPW Insurance) can also be expenses, and may have already been calculated in the total figure on your PFS Document, therefore take care when using this figure! [read more]

Group Shop Sales / Hifi

Items which you sell in your group shop, such as books or motivational tools, should have the full selling price logged. For example, if you sell ‘Book A’ for £4.95, you should consider the full amount as your income for this, not the commission you make (mark up) on the product.

Example:

Josh buys a book from the supplier which costs £4.65, however the product is sold at £4.95 in his group. (30p markup)

The amount to consider as income is the full amount which the product is sold for, £4.95.

The £4.65 cost is an expense which is logged elsewhere

For hifis and magazines, Slimming World is treating you as an exclusive ‘agent’ and these items are on a Sale or Return basis. As such, you can use the commission value to calculate the amount of income you’re receiving from these. The figure for this is shown on your PFS Document.

However, if you are invoiced direct for Hifi Bars (e.g. additional ones which are not sold through your franchise), these can be calculated at the full fee. Keep the receipt, and claim as an expense.

Income sources outside of your group

Selling between colleagues

If you bought something (e.g. visuals) and then sell them to a colleague at a later date, you’re receiving an income for the item you’re selling.

The cost to purchase the item originally will have been logged as an expense.

Advertising with colleagues

If you arrange the advertising for yourself and another colleague(s), you are receiving payment from your colleague for the advert. This is income as you’re paying the full bill (which would be an expense).

Recruitment Bonuses / Prizes

Received a prize or a bonus for recruitment? These are counted as business income. [read more]

Summary

As such, any money which comes into your business is classed as Income for HMRC purposes. You should keep a log of all such income for your annual tax return.