Our reports are designed to provide indicative figures based on the income and expenses provided through your cloud spreadsheets.

The Personal Allowance figure is set to the default amount for the relevant financial year, however if you have income or employment elsewhere, the Personal Allowance may be used elsewhere.

Personal Allowances are per person, not income – therefore you don’t receive a separate one for Self Employment as well as one for Employment, instead all values are added together to work out the relevant taxable amounts.

Julia is employed full time and in 2023/24 receives £15,000 salary from her employment. She has the standard 1257L tax code

The personal allowance of £12,570 would be used up on this employment, therefore the remaining amount (£2,430) and any subsequent profit from self employment would be taxed at the applicable standard rates.

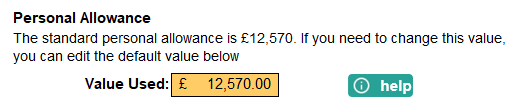

You can now edit the figures provided as part of the calculations – for example where your employment has used your personal allowance, you can change the standard default (£12,570) value to £0.

To access, select the ‘Additional Settings’ button on your Spreadsheet Dashboard. Under the Personal Allowance heading, you can change the value accordingly.

For example, if you have used your personal allowance in other employment, you can reduce this to 0. If your tax code is different, you can add the relevant value here. For example, if you have a tax code of 571L, and no other income, you can enter 5,710 here.