When your MalgraBooks Premium account has been setup, our system will generate a simple cloud accounts system to capture your information which is required for processing your business accounts.

The system can be opened within any modern browser, and is backed up every minute – so you’re safe in the knowledge that any data is secure through our cloud system.

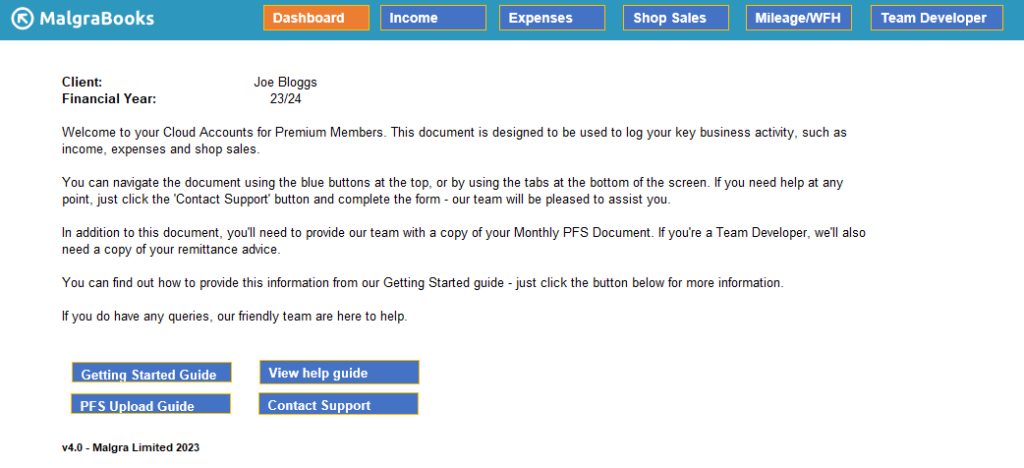

Welcome Screen

The welcome screen is the first item you’ll see once the cloud system opens. The document will introduce its usage, and provide relevant links to different sections of the document

At the top of the screen, blue buttons will help with navigation to relevant screens – such as income or expenses – and you can see which screen you’re currently on as this will be highlighted orange.

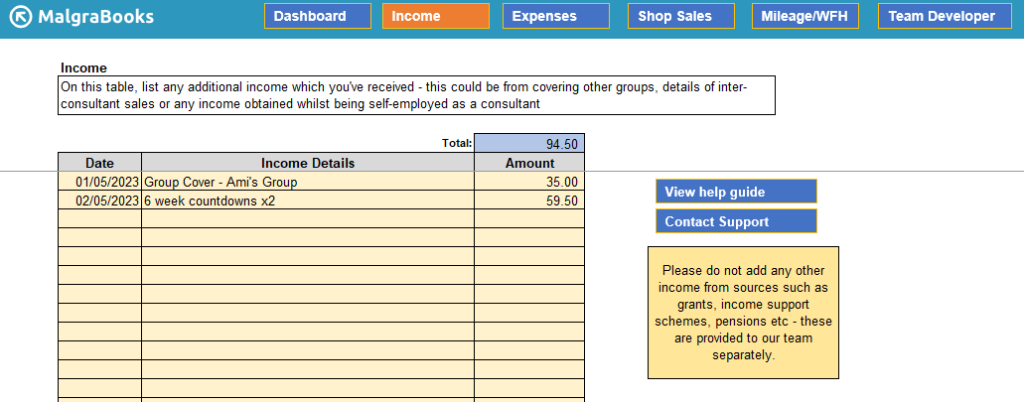

Income

You may encounter additional income sources as a consultant which can be logged on this screen – this could be where you’ve covered a group for another consultant, had any countdown extension (gift voucher) sales, or received income from inter-consultant sales.

There’s also a range of some example income items available here.

To use, simply enter the date, a brief description of the item, and the amount in the relevant columns.

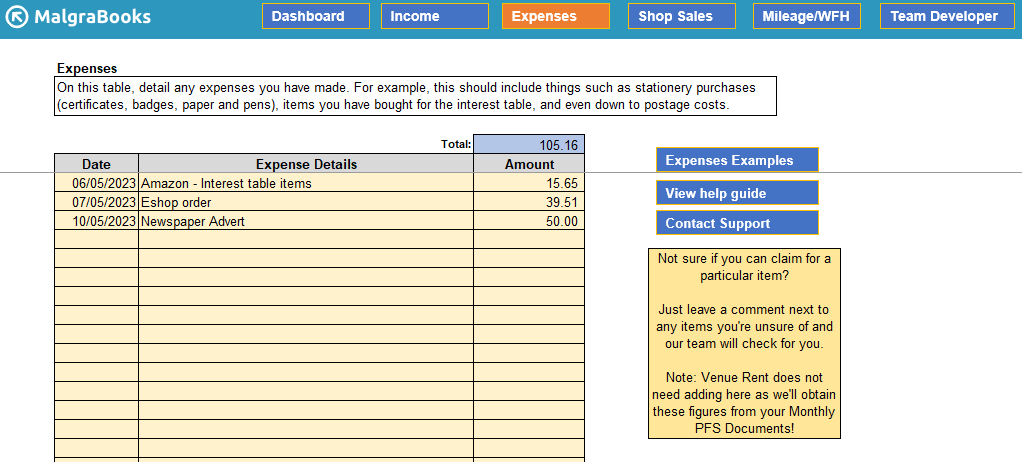

Expenses

The expenses section is similar in format to the income section above, but relates to any eligible business expenses you’ve incurred during the financial year. Again, you can enter items in this section as before.

You can view some expenses examples in our knowledgebase here.

Key tips:

- You don’t need to list every item which is part of a transaction – for example, in the image above we have a Eshop order for 39.51 on 07/05/23. Keep a copy of the full receipt separately if you ever need to reference this transaction with the itemised products, however just a summary is acceptable in this section

- Do not enter Venue Rent here – this will be automatically taken from your monthly PFS Document

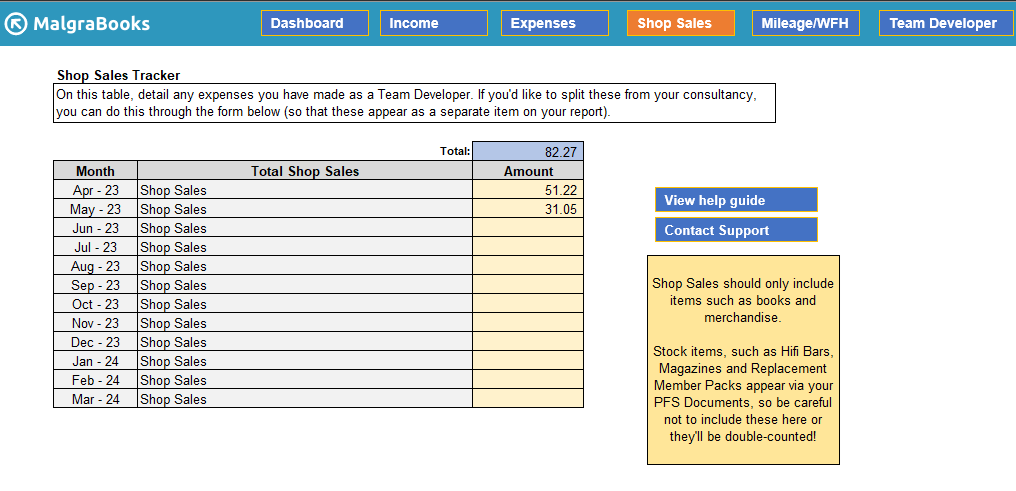

Shop Sales

As well as income from your monthly PFS Document, you’ll also have sales information from your group shop. We recommend keeping a local listing/log of all sales which have taken place during the month – and you can find templates to download from your Member Dashboard.

As before, enter the full monthly values in the relevant sections provided.

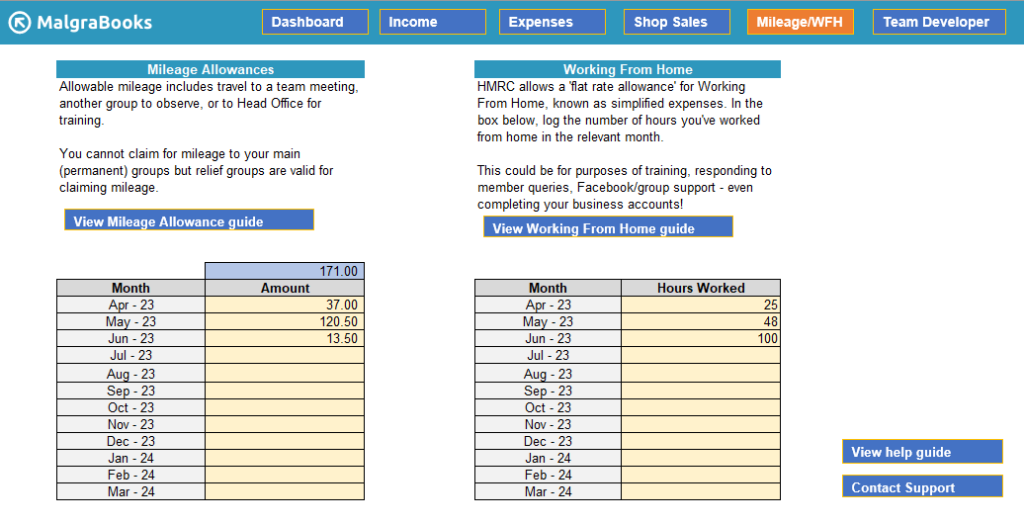

Mileage and Working From Home

This screen provides a section to log any mileage you’ve encountered during the relevant months, and any Working From Home allowances.

Mileage

Eligible mileage can be entered in the box above as the relevant figure – in the example above, we’ve logged 37 miles for the month of April 2023.

We recommend logging all business travel in your A5 Mileage Tracker provided when you joined MalgraBooks. This can then be used to summarise and calculate the relevant values.

Mileage to/from your main groups is not permitted. See the Mileage article for details.

Working From Home

When calculating the Working From Home allowance, HMRC allow a set value to be claimed instead of using the proportioning system (which can have other complexities – see the full article here for details).

You can add the number of hours to the relevant boxes – for example, in the image above we’ve declared 48 hours were worked from home for May 2023.

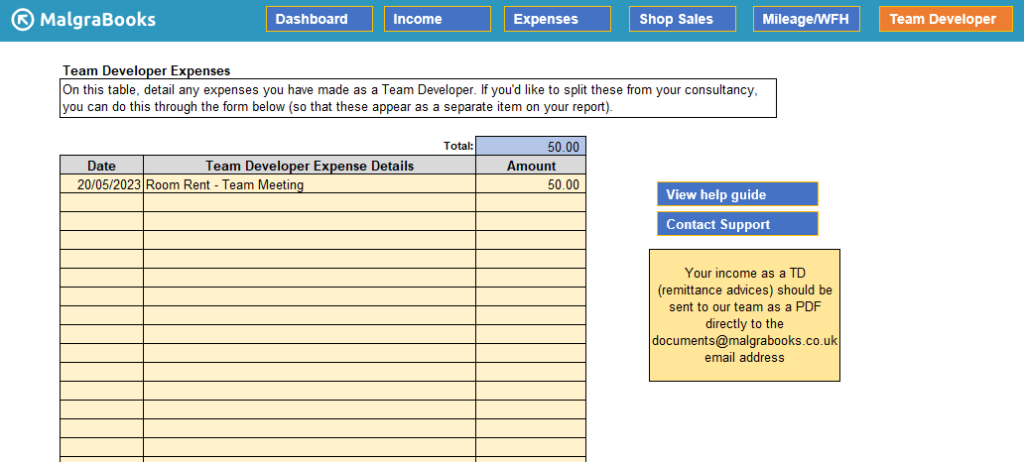

Team Developers

If you’d like to log any expenses incurred as a Team Developer separate from your consultancy, you can add details of any expenses in this screen.

For example above, we’ve added a room rent charge of £50 for a team meeting on 20 May 2023.

With Team Developer Income, simply forward your remittance advice to our team for processing as normal – or upload these via your business portal.