When you’ve completed your business accounts, and the end of the financial year approaches, our team will contact you to advise that it’s time to prepare your annual return.

Cloud Accounts Submission

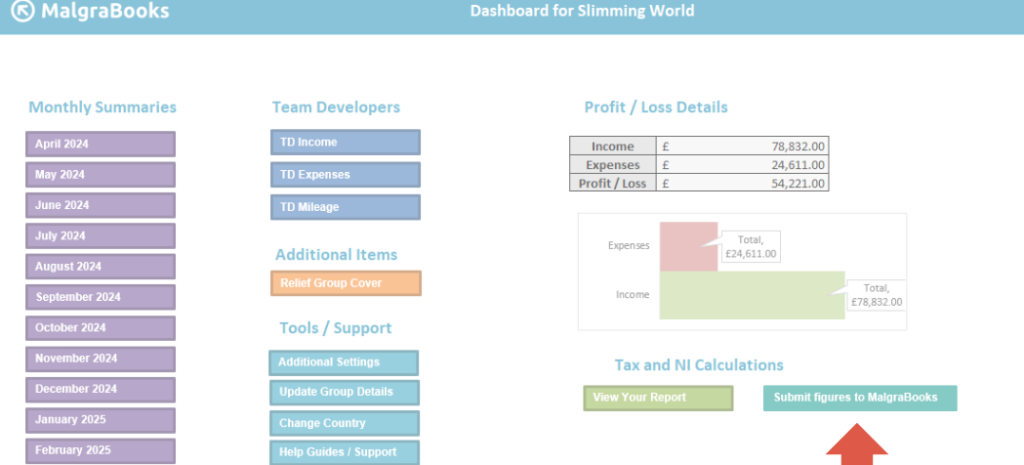

When ready, make any final checks to your data and then head to the Main Menu within your cloud accounts and select the ‘Submit figures to MalgraBooks’ button show below with the arrow.

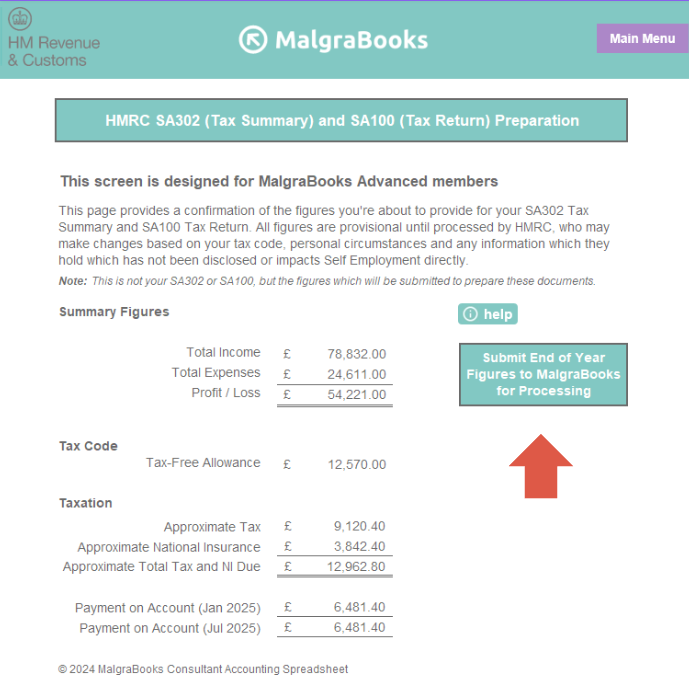

You’ll then be taken to the SA302/SA100 Preparation Screen – this shows a full breakdown of your current data which has been entered into the system.

If you need to make any changes, simply return to the relevant Monthly Summary page and update your data.

Once you’re happy that there’s nothing further to add for your Self Employment, click the ‘Submit End of Year Figures to MalgraBooks for Processing’ button to continue.

This will then take you through to your MalgraBooks Account to confirm the final information for your Tax Return.

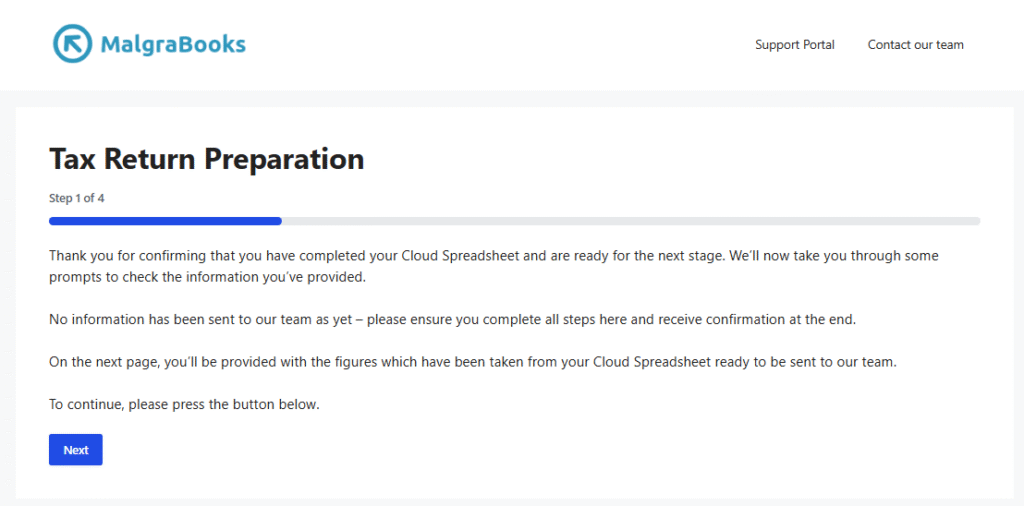

Step 1 – Introduction

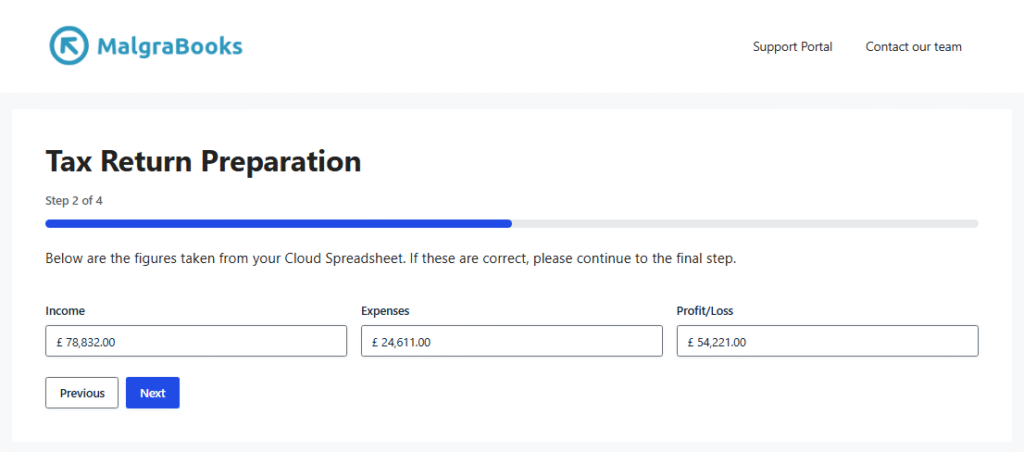

Step 2 – Confirmation of figures

The next step will show a confirmation of the figures which have been obtained from your cloud accounts spreadsheet. Please check these values match those shown as the total Income, Expenses and Profit/Loss from your cloud accounts report screen.

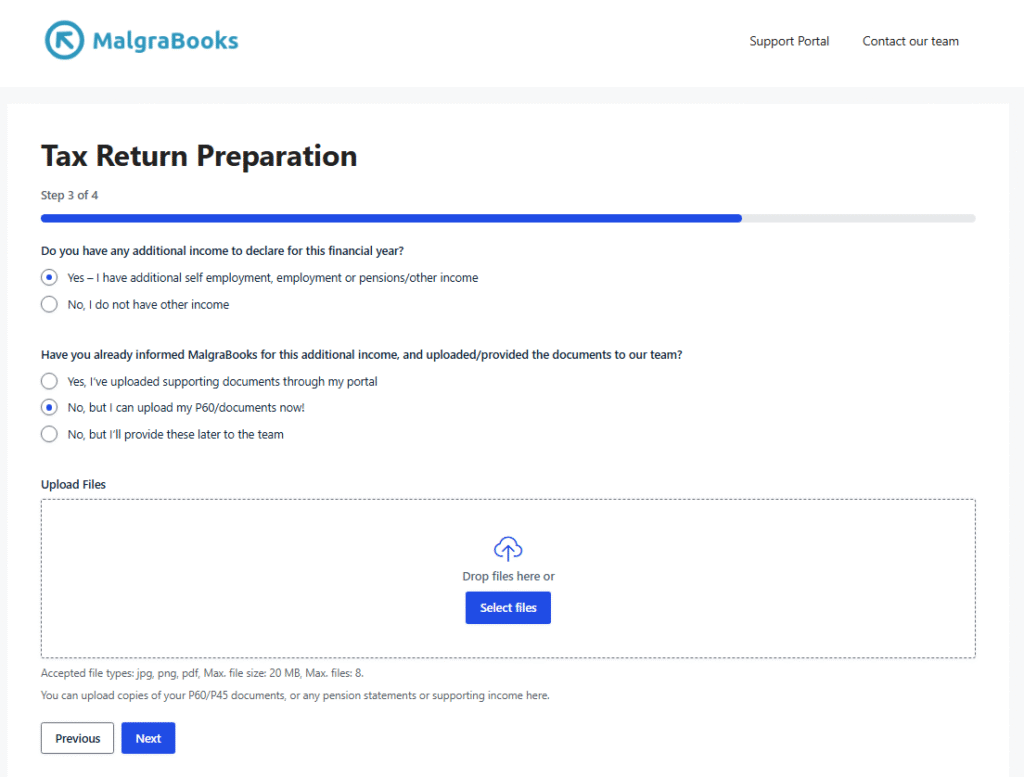

Step 3 – Additional Income Sources

The next screen will ask if you have any additional self employment, employment or pensions/other income for the relevant financial year. If you haven’t, you can select the ‘No, I do not have other income’ option and continue to step 4.

If you have additional income sources, you’ll need to let our team know.

For employment, we’ll need a copy of your P60/P45 document which your employer will have issued to you. You can upload this for our team at this stage, or choose to upload at a later time – our team will contact you for this if we’re unable to obtain the figures electronically from HMRC.

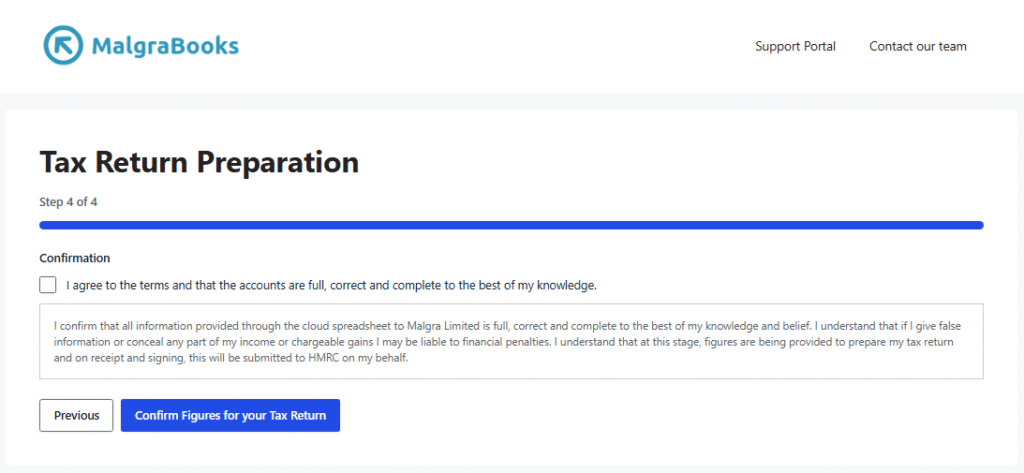

Step 4 – Submission

Once you’ve completed the form, you’ll be provided with a brief confirmation and required to sign that you’re happy for MalgraBooks to process your figures for you.

Once the steps have been completed online, your figures are submitted to our team for final checks to be completed, and preparation of your draft Tax Return which will be sent by email for signoff.

Once signed, the return will be submitted electronically to HMRC.