This section of your return is dedicated to your Self Employment and will require information from your cloud spreadsheet.

Page 1 of 2

Did you have an annual turnover of £85,000 or more?

The first question is related to VAT. If your turnover (income) is more than £85,000 you must register for VAT. If this applies to you, press YES and then continue.

If you are NOT VAT registered, click NO, and you’ll be prompted for some more information to provide details about your self employment.

It’s likely you’ll choose ‘none apply’ at the bottom, but just in case, we’ve listed the main ones here:

- I am a foster carer or adult placement carer: If you are either of these, tick the relevant box

- I wish to make an adjustment to my profits chargeable to Class 4 NICs: It’s likely to not select this unless you need to make an adjustment – this is usually when a charge has been made to your return (such as change of accounting periods) or where you have several employments and self employments which need manually calculating

- I am a farmer, market gardener or a creator of literary or artistic works and I wish to claim averaging adjustment: Self explanatory – if so, tick the box!

- I am a practising barrister: Again, self explanatory

- I have changed my accounting date: You can change your accounting date as a self employed individual. For example, if you wish to align your accounts to the HMRC tax year.

- The results of my accounts, made up to a date in the year to 5 April 2020, have been declared on a previous return: If you provided details of your profits on an earlier return, you can tick this box. This could be if you ended self employment a few days into the new tax year, and submitted these figures previously.

- My ‘basis period’ (the self-employed period for which I am taxable) is not the same as my accounting period: This only applies in certain circumstances, click the ‘Help’ box for examples.

- I provide my services under contracts for professional or other services and these contracts span my accounting date: This only applies in certain circumstances, click the ‘Help’ box for examples.

- My business is carried on abroad: If this applies, tick the box.

- I wish to claim ‘overlap relief’: This is a complex term, but click ‘Help’ if you think this applies.

- My total turnover is £1,000 or less from all self-employments but I wish to voluntarily pay Class 2 NICs: If you had a low turnover in your first year of self employment but wish to pay National Insurance Class 2 contributions (e..g to top up state benefits), you can click this.

- My total turnover is £1,000 or less and I have made a loss: If this is the case, click the box.

- I want to declare disguised remuneration income: It’s unlikely you’ll tick this.

Page 2 of 2 – complete return

Business Name

Choose a name – such as ‘Anna’s Slimming World’ or ‘Slimming World Newtown’

Description of Business, Trade or Profession

Brief description. ‘Slimming World Consultant’ is enough

Postcode of your business address

You can enter your home postcode here

Has your business name, description, address or postcode changed in the last 12 months?

If you have changed any of the previous fields, you can provide information why here

If your business started after 5 April 2019, enter the start date: (optional)

This should be completed if you are a new business which started after this date. If this doesn’t apply, leave this blank

Did your business cease trading after 5 April 2019 but before 6 April 2020?

If you closed your self employment during the financial year, choose YES and provide the date. Otherwise, choose NO.

Date your books or accounts are made up to

Place here the end date. If you’re using our spreadsheets or account book, it’s likely you’re following the HMRC calendar, therefore this would be 05/04/XXXX (where the XXXX is the year when your accounts period runs to).

Did you use the cash basis, money actually received and paid out, to calculate your income and expense?

Cash Basis means that you declare income or expenses as they occur. This is a YES for consultancy, as you pay for items and you buy them, and members give you money as they purchase services or products from you.

The difference here (to clarify) is business traditional accounting, where companies would pay suppliers within 30 days, for example.

Income and Expenses

For this section, you’ll need the figures provided on the dashboard of your MalgraBooks Cloud Spreadsheet. Depending on the version, click the relevant button below to identify where the relevant figures are shown.

- 2021/22 Spreadsheet

- 2022/23 Spreadsheet

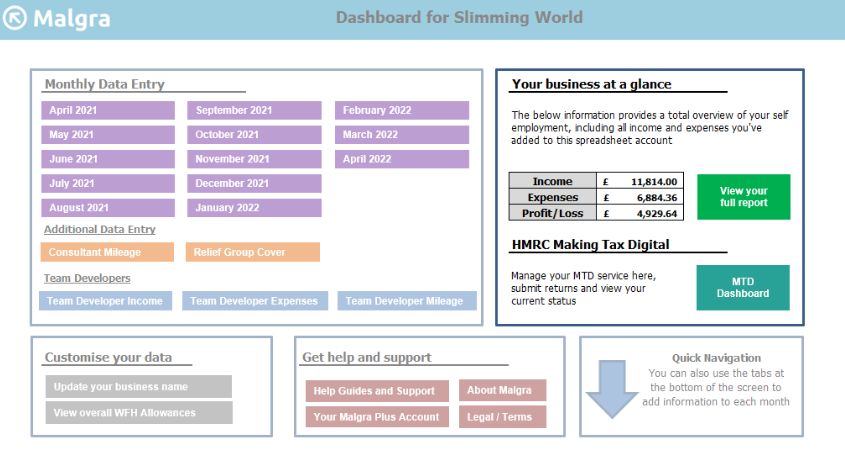

On the 21/22 Spreadsheet, the required figures are on the ‘business at a glance’ section on the Main Menu / Dashboard, located to the right as shown below.

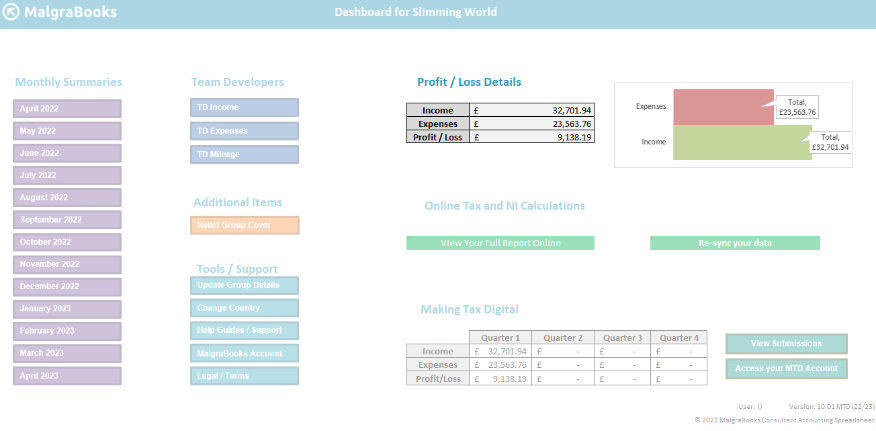

On the 22/23 Spreadsheet, the required figures are on the ‘Profit/Loss Details’ section on the Main Menu / Dashboard, located to the right as shown below.

Turnover – takings, fees, sales or money earned by your business: (optional)

This is the Income figure on your spreadsheet shown above

Any other business income not already included above: (optional)

This should be left blank, unless you’ve left any income out of the spreadsheet.

Trading Income Allowance: (optional)

This usually doesn’t apply, but if it does to you (click the help option on the form to check) and add the relevant information here.

How would you like to record your expenses?

Capital allowance and balancing charges

This section only applies in certain circumstances and guidance is provided on the relevant page.

It is likely to leave this section blank.