It’s easy to forget when you sent your tax return – however you can check your submsision date within your Personal Tax Account.

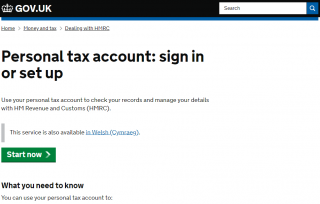

1. Login to your Personal Tax Account

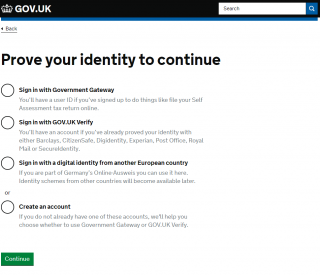

2. Verify using one of the methods listed

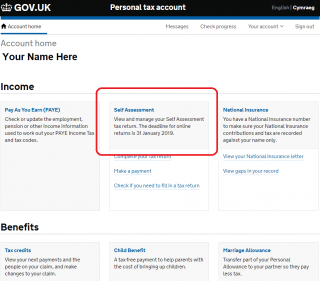

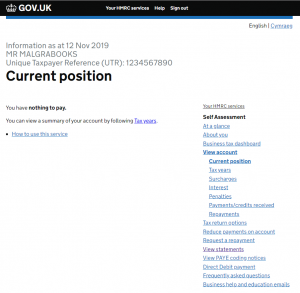

3. Once verified, on the home screen choose ‘Self Assessment’

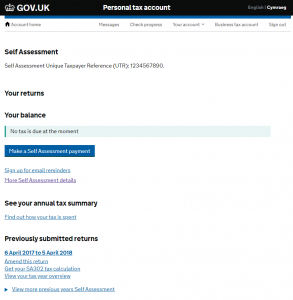

4. On the Self Assessment screen, choose ‘More Self Assessment Details’ (shown in purple text below)

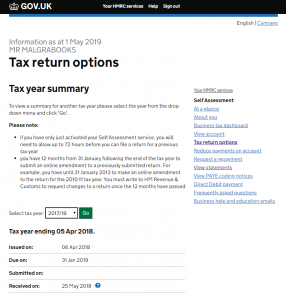

5. Select ‘Tax return options’ from the right hand side list

6. Select the appropiate tax year from the drop down, to view the relevant dates

Note:

- Issued on: Date HMRC advised you (usually in writing) that a tax return is due

- Due on: the date when your tax return was due by

- Submitted on: the date when you submitted your return through HMRC’s system. If you use a different system to submit your return, this may be blank – as with the example shown above

- Received on: The date when HMRC received the tax return