Video Explainer

Full process – step by step

At the end of a reporting period, our system will send an email and text message to inform you that it’s time to prepare your accounts for submission.

Once you receive this email, you’ve approximately 1 month to prepare and submit your details through the online system.

To do this, first you’ll need to ensure you cloud spreadsheet is up to date, and has all income and expense amounts added for the last three months.

Once ready, head to the MTD screen and check the details have passed through correctly.

Navigation

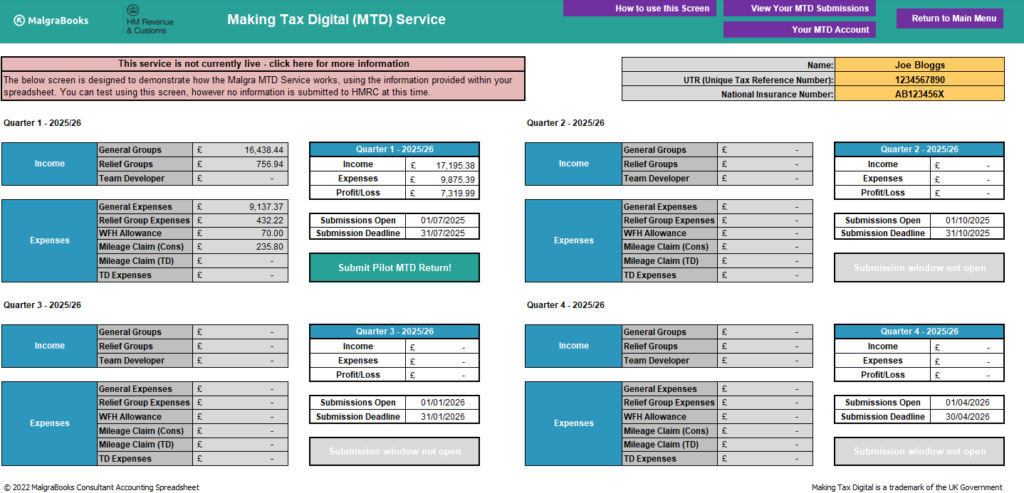

The screen is split into 4 different quarters as required for reporting through the MTD system. The top left covers Quarter 1 as an example.

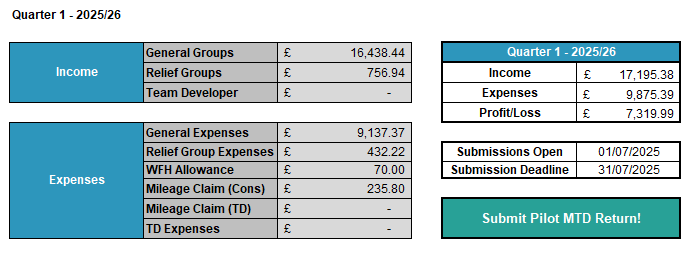

The tables calculate the relevant information for your MTD return from the information contained within the spreadsheet. In the example above, the income from running groups and relief groups are listed, along with expenses for the period for general group running and also from the relief.

The total for the period of income is £17,195.38 and expenses £9,875.39 – leaving a profit of £7,319.99.

The dates cover the indicative periods of when the return can be submitted to HMRC. In this example for Quarter 1 (April – June), the window to submit opens on 1 July and runs until the end of the month (31 July).

In this example, the button to ‘Submit Pilot MTD Return’ is active as the window is open, once ready click this and you’ll start the MTD Process.

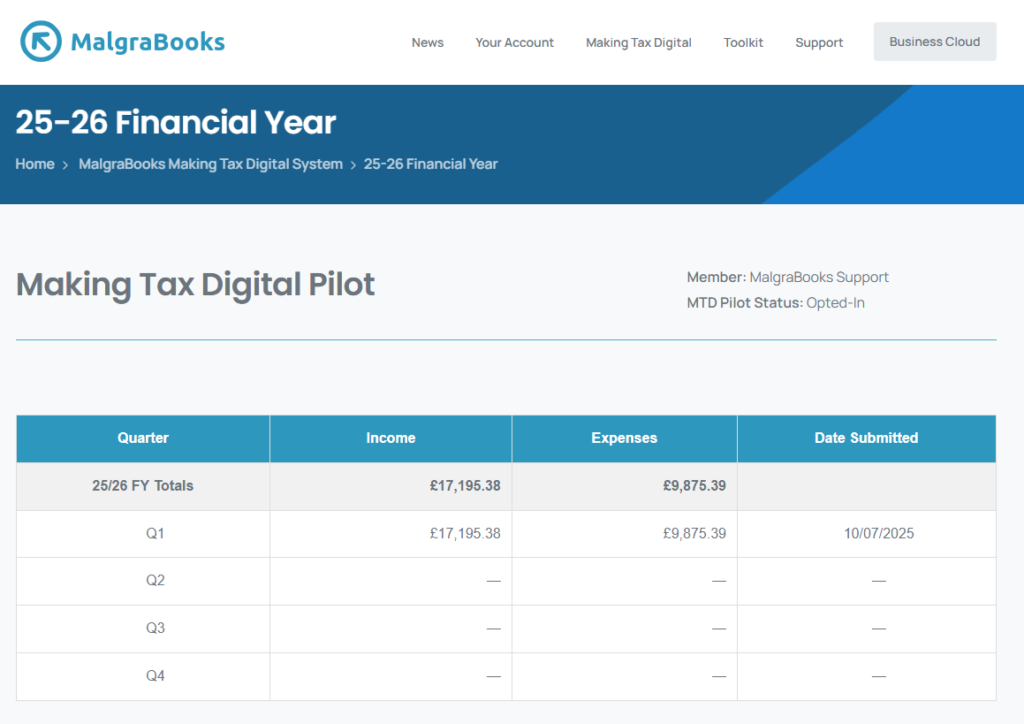

Once you’ve confirmed the details, they would normally be submitted to HMRC, but during the pilot this will not happen – instead, they’ll show on your MTD Online Dashboard with the relevant figures.

And that’s it – you then then continue your accounts as normal until the next period!