If you’re VAT registered and you’ve now dropped below the £85,000 threshold since 1 April 2019, you can ‘de-register’ for MTD submissions through the HMRC website.

To do this:

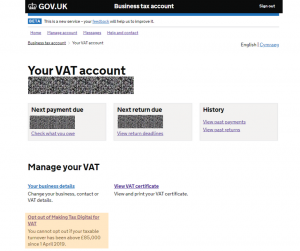

- Login to your HMRC VAT Account

- On your dashboard, in the ‘Manage your VAT’ section, you can click ‘Opt out of MTD for VAT’

-

Follow the prompts to answer the relevant questions on screen

-

HMRC will then confirm to you if you can be de-registered for MTD