Input VAT is added to the price when goods and services are purchased that are liable to VAT and known more commonly as Purchases (or expenses).

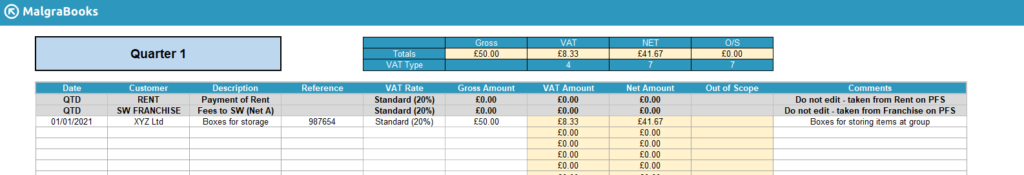

The fields should be completed as below:

- Date: Date of the transaction

- Customer: Name of the person or company whom you purchased the item from

- Description: Details of what the transaction was for

- Reference: If you were provided with a reference for the transaction (such as on an invoice), this can be added here

- VAT Rate: Choose from the relevant rate. Most items will be Standard (20%)

- Gross Amount: The full purchase price

- Comments: Add any comments here about the transaction for your records

To enter a item, simply add the details to the next available row in your spreadsheet as below.

In this example, the consultant has purchased some storage boxes from XYZ Ltd. The details have been completed as per the invoice, and the system has calculated the relevant VAT amounts.

Note: You should keep a copy of the receipt for VAT goods and services purchased which must contain the VAT number of the relevant organisation.