‘Retained Earnings’ is a term which Slimming World uses to show the balance remaining, when items such as Rent and Nett Fees A (Slimming World Franchise Fees) have been paid out.

As you’re a business, retained earnings is only half the story of your income (or a third!), and isn’t the ‘true member fees income’ figure for your group.

The number should not be used as your ‘income’ on it’s own as it’s not an accurate figure of ‘earnings’.

Therefore, don’t use this as your overall income for a group – we’ll explain below how to understand your actual income.

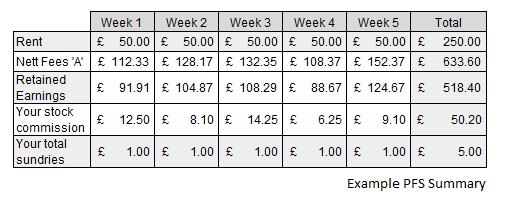

Example PFS Document:

The above summary is used throughout this guide, and we’ll concentrate on the group which ran on Week 1 for the rest of this article.

From the summary, it suggests that the retained earnings is £91.91. This is correct, as it’s the amount left over after you’ve considered any immediate deductions following the end of group.

To understand your true income for the group fees, you’d need to follow the below calculation:

Nett Fees A + Retained Earnings + Rent Paid = Total Fees Taken

The total fees taken would then be your member fees for this group. From our example, this would be:

112.33 (Nett Fees A) + £91.91 (Retained Earnings) + £50 Rent = £254.24

Therefore, £254.24 was the ‘income from member fees’ for this group.

The different from the ‘retained earnings’ figure of £91.91 and the member fees income figure of £254.24 is significant – imagine the difference at the end of the year between these two figures.

When it comes to business turnover, it’s essential you understand your income and expenses to calculate the accurate figures for your tax return.

There’s other sources of income to consider too – this article only covers Retained Earnings and why they’re important – check the ‘What is Income when I’m a Consultant’ article for more information.

Key points:

- Retained Earnings is a figure calculated after two key expenses are deducted, Net Fees A and Rent.

- You need to calculate the sum of these three aspects to reach your member fees income

- Net Fees A and Rent are still expenses – you’ll need to deduct them on your expenses later on. If you’re using our spreadsheets, the system will calculate this for you