If you’ve paid too much tax to HMRC, you’re entitled to a refund. Tax overpayments can happen for various reasons, and HMRC will either refund the money automatically or you can request it through your Personal Tax Account.

Why You Might Be Owed a Refund

Common reasons for tax overpayments include:

- Wrong tax code: Your employer used an incorrect tax code, causing too much tax to be deducted from your salary

- Self-employment losses: Your business made a loss, offsetting tax paid on employment income

- Changed circumstances: You stopped working mid-year but had already paid tax as if you’d work the full year

- Multiple employments: Tax was calculated incorrectly across multiple jobs

- Payments on account: You paid advance tax for self-employment, but your actual profits were lower than expected

- Tax relief claims: You claimed expenses or reliefs that reduced your tax bill

- Pension contributions: You made pension contributions that qualify for tax relief

How HMRC Notifies You

The P800 Tax Calculation

If HMRC identifies that you’ve overpaid tax through employment (PAYE), they’ll send you a P800 tax calculation by post. This document shows:

- How much tax you should have paid

- How much tax you actually paid

- The difference (your refund amount)

- Instructions on how to claim your refund

P800s are typically issued between June and November following the end of the tax year.

Self Assessment Refunds

If you complete a Self Assessment tax return and it shows you’ve overpaid, the refund will appear on your Self Assessment account. HMRC won’t automatically send the money – you need to request it through your Personal Tax Account.

⚠️ Beware of Scams

Common scam tactics include:

- Emails claiming to be from HMRC about a tax refund

- Text messages with links to claim refunds

- Phone calls offering to “fast-track” your refund

- Fake websites that look like HMRC

- Requests for payment to “process” your refund

- Pressure to act immediately or lose your refund

HMRC’s official communication methods for refunds:

- P800 letter sent by post

- Information visible in your Personal Tax Account

- That’s it – no other methods

How to Check If You’re Due a Refund

Before providing any bank details or taking action, verify your refund status through your secure HMRC Personal Tax Account. This is the ONLY safe way to check.

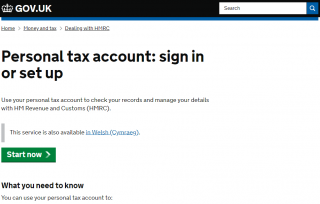

Step 1: Log In to Your Personal Tax Account

Go to https://www.gov.uk/personal-tax-account and sign in using your Government Gateway credentials.

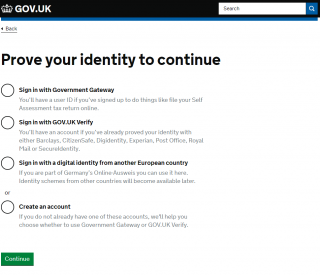

Step 2: Complete Two-Factor Authentication

Verify your identity using one of the methods listed (typically a code sent to your mobile phone or authentication app).

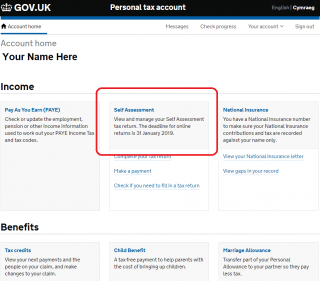

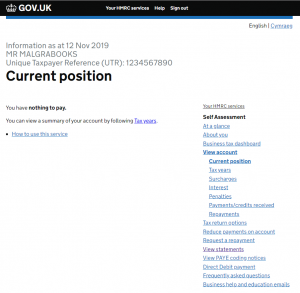

Step 3: Navigate to Self Assessment

Once logged in, select “Self Assessment” from your account home page.

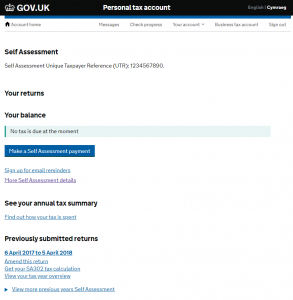

Step 4: Access More Self Assessment Details

On the Self Assessment screen, choose “More Self Assessment details” (shown in purple text).

Step 5: Check for Refunds

Look for “Request a repayment” or “Get a refund” in the menu options on the right-hand side.

If a refund is due, you’ll see:

- The amount you’re owed

- Which tax year it relates to

- Options to claim the refund

How to Claim Your Refund

Once you’ve confirmed a refund is due, you have several options for claiming it:

Option 1: Online Through Your Personal Tax Account (Fastest)

If the option is available, you can request the refund directly through your Personal Tax Account:

- Select “Request a repayment”

- Choose the refund you want to claim

- Provide your bank details (or confirm existing details)

- Submit your request

Refunds requested online are typically paid within 5 working days.

Option 2: Through Your P800 (PAYE Refunds)

If you received a P800 by post, it will tell you how to claim:

- Bank transfer: Follow the instructions on the P800 to claim online or by phone

- Cheque: If you don’t provide bank details, HMRC will send a cheque (this takes longer – allow up to 6 weeks)

Option 3: Let HMRC Adjust Your Tax Code

For smaller amounts (typically under £50), you can choose to have the refund applied through an adjustment to your tax code instead. This means you’ll pay less tax in the coming months until the overpayment is recovered.

This option is automatic for very small amounts.

Option 4: Apply It to Future Tax Bills

If you have upcoming tax liabilities (such as Self Assessment payments due), you can request that HMRC applies the refund to those bills instead of paying it to you.

This is useful if you:

- Have payments on account due soon

- Expect to owe tax for the current year

- Want to avoid the admin of receiving and then repaying money

How Long Does It Take?

- Online request (bank transfer): 5 working days

- P800 with bank details provided: 5 working days

- Cheque payment: Up to 6 weeks

- Tax code adjustment: Applied over the following months

What If I Don’t See a Refund?

If you believe you’re owed a refund but can’t see it in your Personal Tax Account:

Check Your Tax Return Was Processed

If you recently submitted a Self Assessment return, HMRC may still be processing it. Allow a few days after submission for the calculation to update.

Verify Your Tax Calculation

Download your SA302 tax calculation to confirm that it shows an overpayment. Sometimes what seems like an overpayment may have been offset against other tax liabilities.

Check If HMRC Has Offset the Refund

HMRC may have automatically applied your refund against:

- Outstanding tax bills from previous years

- Upcoming payments on account

- Other tax debts (such as tax credits overpayments)

Check your account statement to see if this has happened.

Contact HMRC

If you’ve checked all of the above and still believe you’re owed a refund that isn’t showing, contact HMRC’s Self Assessment helpline on 0300 200 3310.

Time Limits for Claiming Refunds

You have 4 years from the end of the tax year to claim a refund.

For example:

- Tax year 2020/21 (ended 5 April 2021) – claim by 5 April 2025

- Tax year 2021/22 (ended 5 April 2022) – claim by 5 April 2026

- Tax year 2022/23 (ended 5 April 2023) – claim by 5 April 2027

Interest on Refunds

HMRC pays interest on some tax refunds, but the rules are complex:

- Self Assessment refunds: Interest is paid from the date the payment was made to HMRC until the refund is issued

- PAYE refunds: Usually no interest is paid on P800 refunds

- Interest rate: The Bank of England base rate minus 1% (minimum 0.5%)

Interest on refunds is taxable income and should be declared if it exceeds your personal savings allowance.

Common Questions

Can I Get My Refund Paid to Someone Else’s Bank Account?

No. For security reasons, HMRC will only pay refunds to a bank account in your own name. If you don’t have a bank account, request a cheque instead.

What If My Bank Details Have Changed?

When requesting a refund online, you’ll be asked to provide or confirm your bank details. You can update them at this point.

I Received a Refund But Don’t Think I Should Have

If you receive a refund that seems incorrect:

- Check your tax calculation in your Personal Tax Account

- Don’t spend the money until you’re certain it’s correct

- Contact HMRC if you think there’s been an error

- HMRC can reclaim incorrect refunds, sometimes years later

Will a Refund Affect My Benefits?

Tax refunds are not normally counted as income for benefit purposes. However, if you’re claiming means-tested benefits and the refund increases your savings above the threshold, it could affect your entitlement.

Important Reminders

- ✅ Always verify refunds through your Personal Tax Account – never trust emails or text messages

- ✅ Keep your bank details up to date with HMRC for faster refunds

- ✅ Claim refunds promptly – don’t wait until the 4-year deadline

- ✅ Check your tax code if you received a P800 – make sure it’s corrected for the current year

- ✅ Keep records of all refund requests and payments

- ❌ Never provide bank details in response to emails, texts, or phone calls

- ❌ Never click links in messages claiming to be from HMRC

- ❌ Never pay a fee to “release” a refund

Contact HMRC Safely

If you need to contact HMRC about a refund, ONLY use their official contact methods:

- Self Assessment helpline: 0300 200 3310

- PAYE and Income Tax helpline: 0300 200 3300

- Online: Through your Personal Tax Account at https://www.gov.uk/personal-tax-account

- Full contact details: https://www.gov.uk/government/organisations/hm-revenue-customs/contact/self-assessment

Need Help?

If you’re unsure about a refund or need assistance:

- Contact MalgraBooks support if we manage your tax affairs

- Call HMRC’s Self Assessment helpline on 0300 200 3310

- Check the official HMRC guidance on tax overpayments and refunds