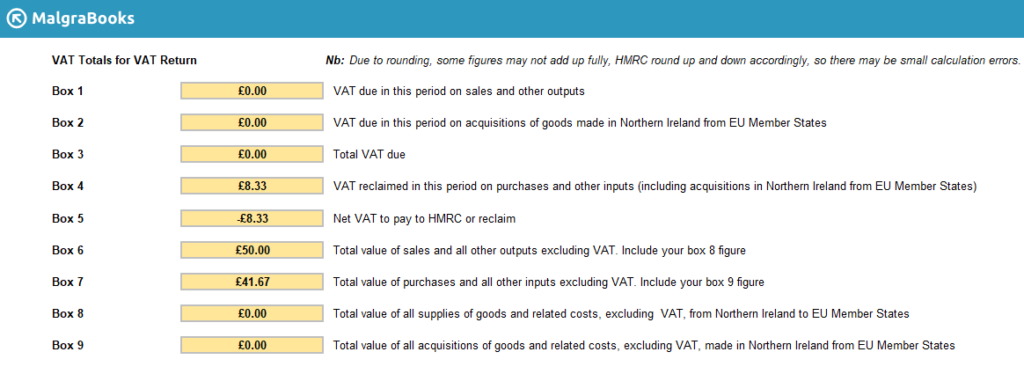

The VAT Return Summary provides an overview of your account for the relevant VAT Quarter, based on the information provided within the cloud accounts system.

Box 5 shows the total amount due (or for refund)

The codes are:

| VAT Box | Description |

|---|---|

| 1 | VAT due in this period on sales and other outputs |

| 2 | VAT due in this period on acquisitions of goods made in Northern Ireland from EU Member States |

| 3 | Total VAT due |

| 4 | VAT reclaimed in this period on purchases and other inputs (including acquisitions in Northern Ireland from EU Member States) |

| 5 | Net VAT to pay to HMRC or reclaim |

| 6 | Total value of sales and all other outputs excluding VAT. Include your box 8 figure |

| 7 | Total value of purchases and all other inputs excluding VAT. Include your box 9 figure |

| 8 | Total value of all supplies of goods and related costs, excluding VAT, from Northern Ireland to EU Member States |

| 9 | Total value of all acquisitions of goods and related costs, excluding VAT, made in Northern Ireland from EU Member States |