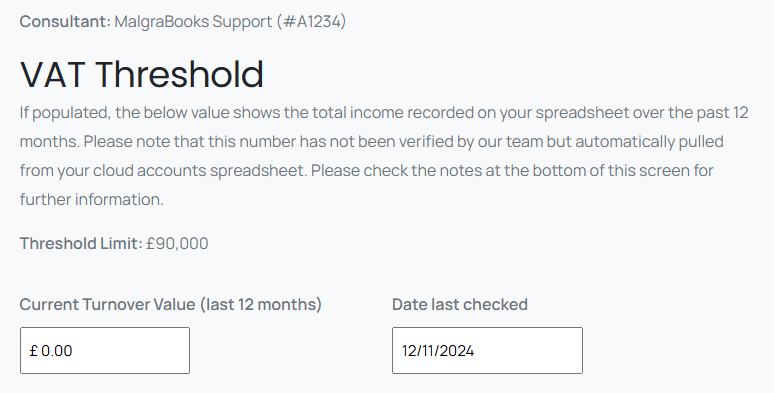

You can use our VAT Threshold Checker to see where your current level of turnover relates to your VAT threshold.

Our system runs a report each month to check the overall turnover for the past 12 rolling months for all Essentials and Advanced members. Each month, the value is refreshed and updated. If you exceed the current VAT threshold, the system will email you a warning message, and details of what action to take.

For Premium members, our team automatically check this each month for you when we manage your tax return, and your account manager or team member will be in touch if you’re approaching the threshold.

If the system shows ‘no turnover figure recorded’ this means that the system couldn’t calculate for you over the past 12 months. If you have not yet input any data to your cloud accounts spreadsheet, this could be why – the system doesn’t yet know your turnover.

We’re aware that there may be discrepancies in the below scenarios:

- You have entered an incorrect date against Relief Group or TD Income values

- No date has been entered against a income or expenses value

We’re currently planning enhancements to this tool for:

- Show breakdown of more data

- Analysis of Relief Group cover