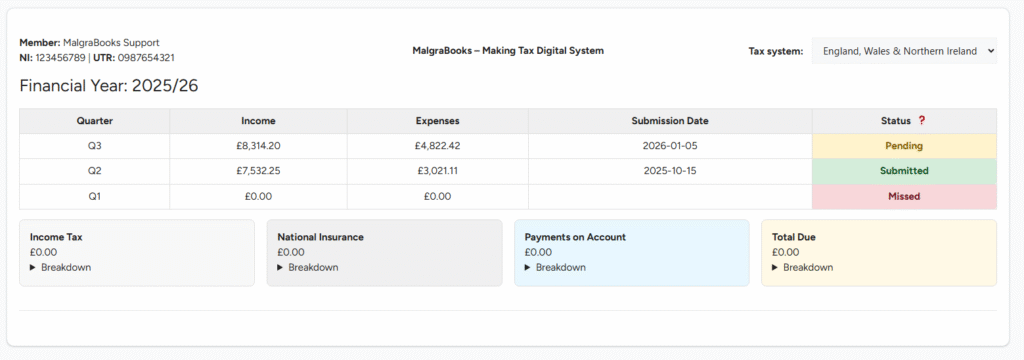

You can access your MTD Dashboard through the ‘Making Tax Digital’ link on the portal menu. This is where you can view your quarterly submissions to HMRC.

The dashboard shows the current financial year and the status of quarterly submissions through your cloud accounts software. The total income, expenses and the submission date is shown.

The status column will show one of three options

- Missed: You missed this quarterly submission and may have been allocated a penalty point

- Pending: Your submission is being processed

- Submitted: Your submission has been accepted by HMRC

Underneath, you’ll find a number of boxes showing the overall income, national insurance, payments on account and tax balance due for the full year.

In this image, no tax is currently due on the profit of £8,002.92. If any was due, it would show a breakdown of the relevant numbers.