When our team have processed your tax return details, we’ll prepare your SA100 Tax Return document, which includes the SA302 Tax Calculation (this is the last page in the document we send).

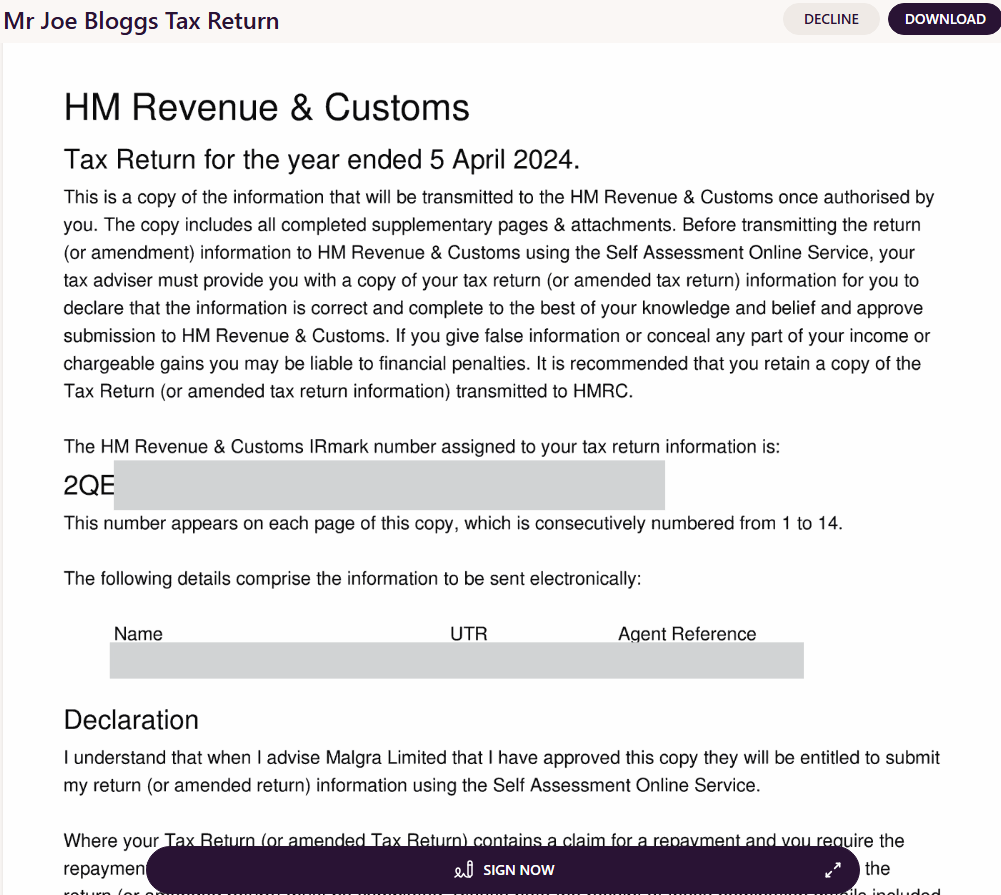

Once ready, you’ll receive an email explaining that your tax return is ready to check through with a link to view the document. If you’re happy with the details, you can e-sign the document, and our system will automatically queue the return for submission.

When you open the document, please take time to read through the details provided and check that you’re happy with the information. Once ready, click ‘Sign Now’ at the bottom of the page.

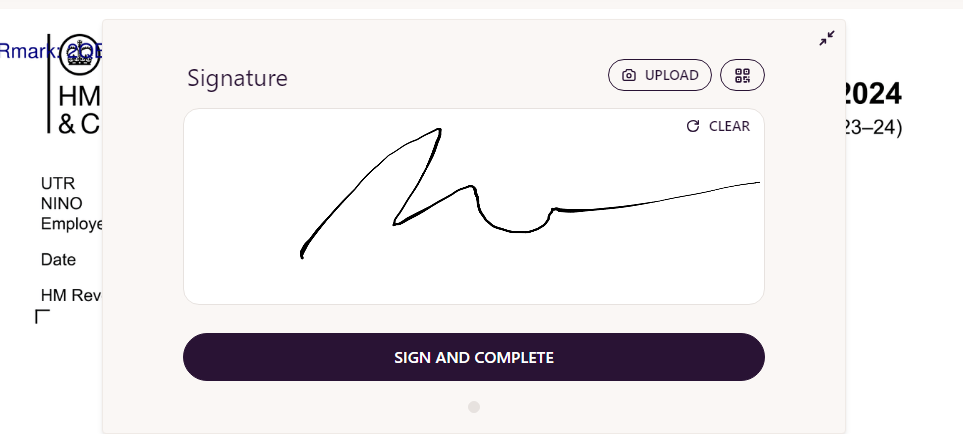

The webpage will then load up a short signature screen for you to complete.

Once done, simply click ‘sign and complete’ and you’re done.

Our system will email a copy of the file, and place your document in an automated queue for processing.