As a business, you’re required to keep accurate records of items you buy and sell. This article explains how to keep track of book purchases and sales.

Note: Magazines and Biscuit bars (HiFi) are not classed as stock as you do not ‘physically’ purchase these. Instead, they’re provided on a ‘sale or return’ basis. The amount you receive for each sale is classed as ‘commission’ and comes under your income.

If you do not return Magazines and are invoiced for these at a later point at full price, this can be an expense.

Expenses

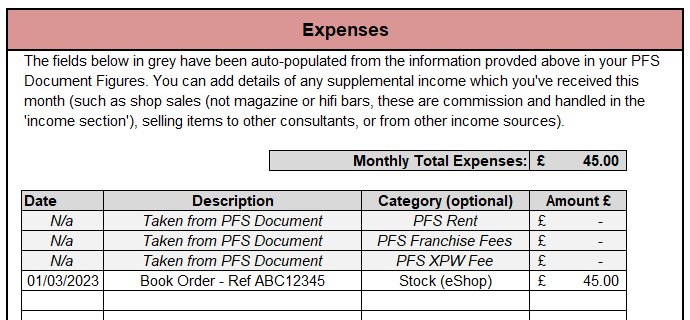

Your initial purchase of books from the eshop will appear in your expenses section. You don’t need to list every item purchased, instead if the items are from 1 transaction they can be listed with the relevant order reference to help you locate the receipt at a later time, if required.

For example – we’re going to assume we made an order on 1 March 2023 for 10 books at a price of 4.50 each from the eShop. As such, we’d log the items as below.

In the screenshot above, you can see the books have been added with a reference of ABC12345 – which helps aid memory if we need to locate these at a later point.

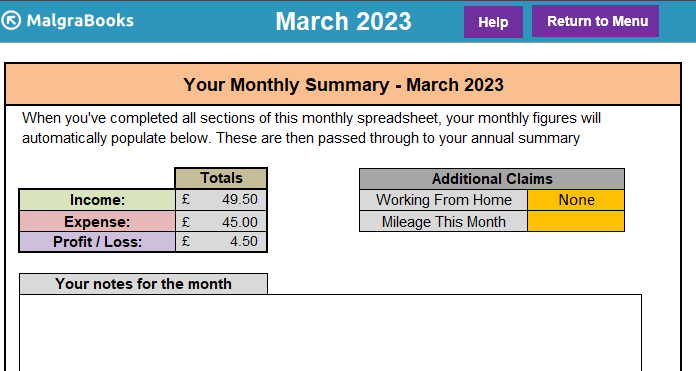

The system has automatically added £45 to the expenses claim for this period.

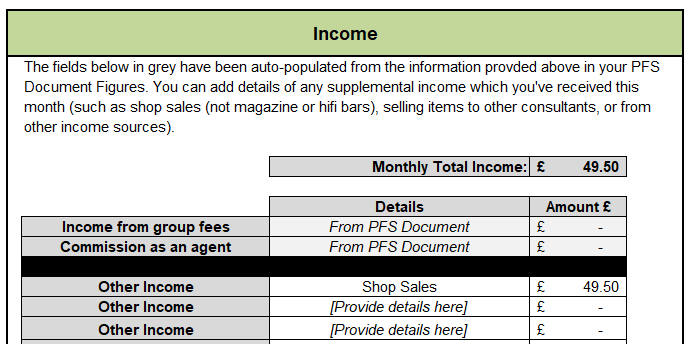

Income

Let’s assume that we sold all of the books during this period at their selling price of £4.95. As such, this would be £49.50 added to the expenses section as below.

The full selling price is added here. The system will automatically record the profit difference in the database.