This report gives you a clear picture of how your Slimming World business is doing financially over the year. It’s called a Profit & Loss account (or P&L for short).

All it really does is add up your income and take away your expenses to show whether you’ve made a profit or a loss.

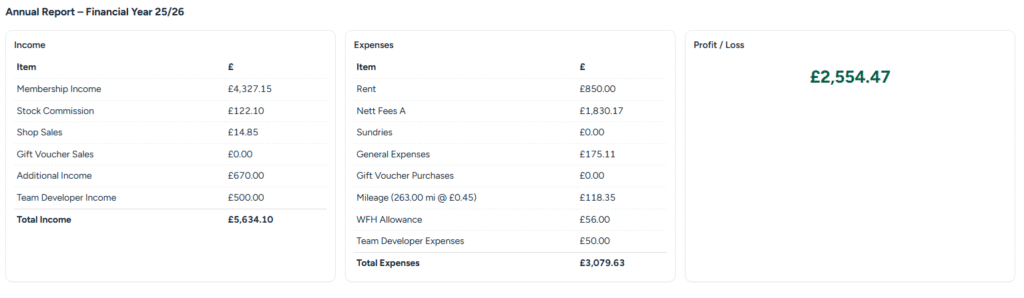

Income – what you’ve earned

This is the money coming in from your groups and related activities. For example:

- Membership Income – the total money you receive from members (added up from each week)

- Stock Commission – any Slimming World products you sell on at group (like Hi-fi bars) and the commission you earn on them

- Shop Sales – these are items you sell directly, such as receipt books

- Gift Voucher Sales – for extending countdowns and selling gift vouchers

- Additional Income – things like bonuses or extra payments

- Team Developer Income – if you’re a Team Developer, that income is shown here too.

Expenses – the costs of running your group

Running a group has some costs attached, and these are listed here, such as:

- Venue Rent – the money you pay to hire your group’s venue.

- Nett Fees A – Slimming World’s consultant fees.

- Mileage – travel costs for getting to other Slimming World events, training etc.

- WFH Allowance – HMRC’s allowance for any home working.

- General Expenses – smaller day-to-day costs of running your group.

Profit / Loss – what’s left over

Once expenses are taken away from income, the P&L shows your profit.

In this example, after covering all venue rent, fees, travel, and other costs, there’s a profit of £2,554.47.

This is the amount you’ve effectively earned from your Slimming World business this year.

What this report is:

- A way to see the “true” earnings from your role, once your costs are taken into account.

- A tool to help you manage your business and prepare for your tax return.

- A clear record of how your Slimming World work balances out financially.

What this report isn’t:

- It’s not a payslip – it doesn’t show money going into your bank.

- It’s not about cash flow – payments in and out may happen at different times, but this report just totals them up.

- It’s not a bill – you don’t need to pay anything based on this screen.

Think of it as your financial health check for the year: how much came in, how much went out, and what’s left as your profit.