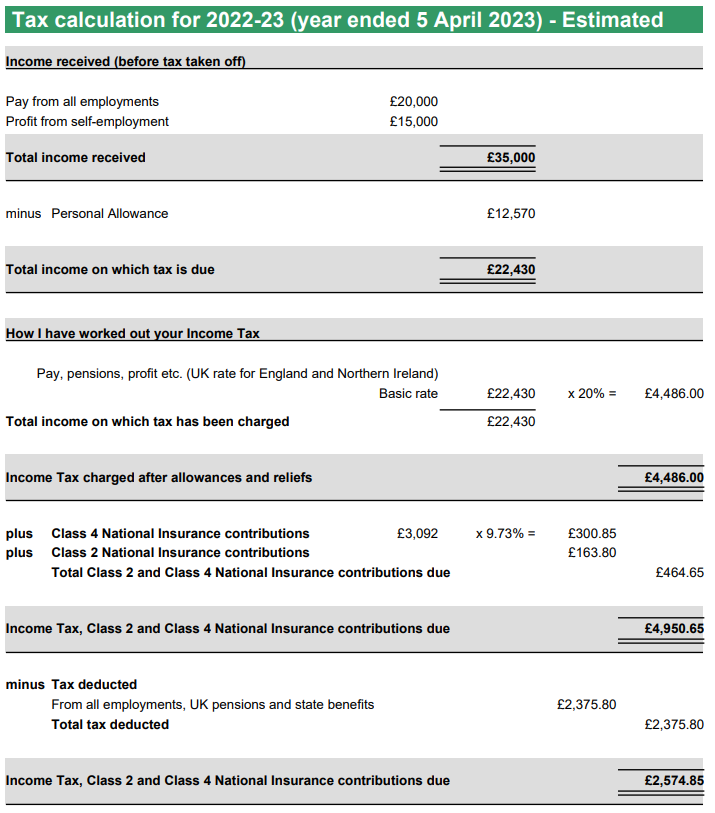

Form SA302 (Tax Computation/Calculation) is evidence of your earnings and used to show the calculations of Tax and National Insurance which have been used to prepare your tax return.

If you’re a MalgraBooks Advanced or Premium client, you’ll receive a copy of this document before your return is submitted to HMRC. This page explains what your SA302 Tax Calculation document means, and how the calculations have been made.

This article will use an example document (available at the bottom of this page in full here) to explain the calculations and how they have been made.

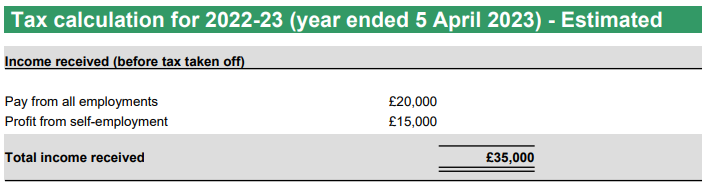

Total Income

The initial section shows how much income in total has been earnt from any income sources, such as employment and profits from self-employment. This section also may reference items such as dividends, pension schemes or other income sources.

The total income is then shown at the bottom – this value is used for the remainder of the document. In this example, the individual has earnt £20,000 from their employment, and £15,000 profit from Self Employment, therefore a total of £35,000 for this financial year.

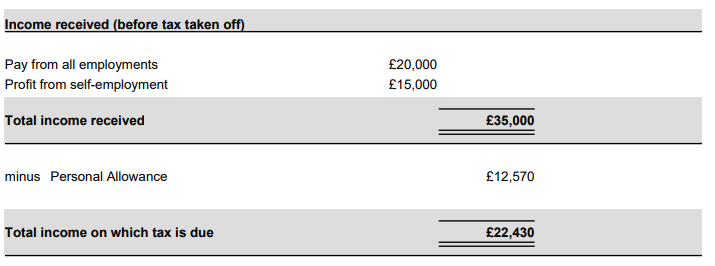

Personal Allowance

The total income amount next has the Personal Allowance deducted. This is usually a standard amount, however you may have different values depending on your tax code. For the purposes of the SA302, HMRC assume the standard code, and then will make amendments at a later time if these are different.

The personal allowance is a tax free amount which you’re able to earn before any tax has been taken off. In this example, the amount of £12,570 (for the 22/23 tax year) has been deducted from the £35,000 calculated in the previous section.

£22,430 is the remaining value, and this is now subject to Tax and National Insurance.

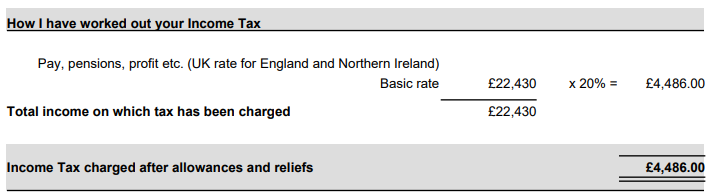

Income Tax

In this section, the standard rate of tax has been applied to the remaining value of £22,430. This is currently 20% of the amount, therefore leaving a balance of £4,486 due as tax.

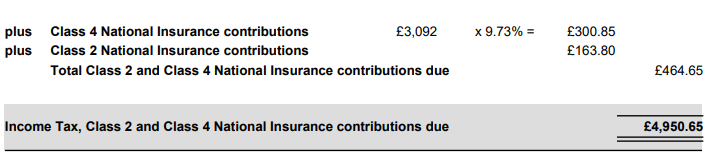

National Insurance

In this section, National Insurance has been applied. There are two different types relating to Self Employment (you can find out here about them), and they’ve been applied in this section.

Note: Class 4 is a percentage over a specific amount, therefore this will vary depending on your personal circumstances. Class 2 is a flat rate.

From the calculations, £464.65 is due as National Insurance, and is added to the previous sections’ tax amount of £4,486 to bring the new total to £4,950.65.

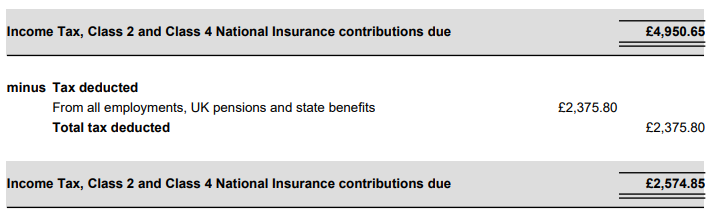

Minus already paid

In the example above, the individual had Employment Income of £20,000 which would have been taxed at source through PAYE. As such, the amount of Tax and National Insurance paid through their salary is deducted in this section.

They have already paid £2,375.80, therefore this is deducted from the tax amount due of £4,950.65, leaving a remaining balance of £2,574.85 due as the total amount of tax and national insurance.

Note: This example does not include Payments On Account which may be applied.

Full Example Document

A full copy of the document is shown below and has been used as an example through this article.