Form SA302 (Tax Computation/Calculation) is evidence of your earnings and used to show the calculations of Tax and National Insurance which have been used to prepare your tax return.

If you’re a MalgraBooks Advanced or Premium client, you’ll receive a copy of this document before your return is submitted to HMRC. This page explains what your SA302 Tax Calculation document means, and how the calculations have been made.

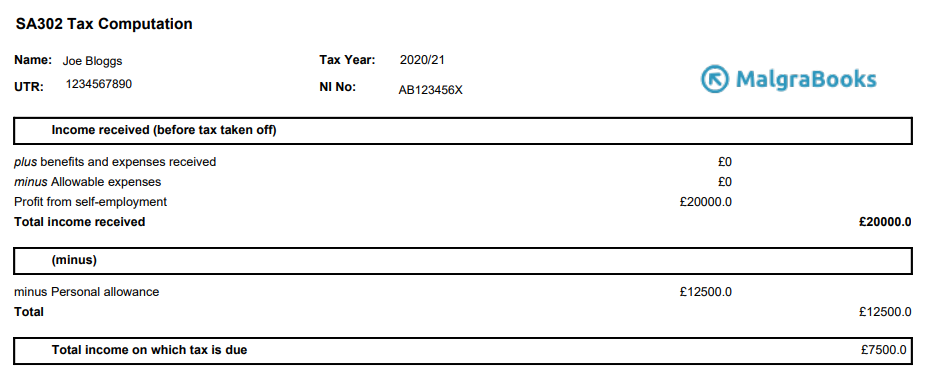

Income Received

The top section shows your personal information, and then a summary of any income received during the relevant financial year.

In this example, profits of £20,000 were incurred by the self employed individual, and they had no earnings from any other employment or self employment.

The next part shows the personal allowance being deducted from the total income received value. For the 20/21 financial year, the allowance was £12,500 – therefore from the profit of £20,000 this leaves £7,500 as the balance subject the next steps in the calculation.

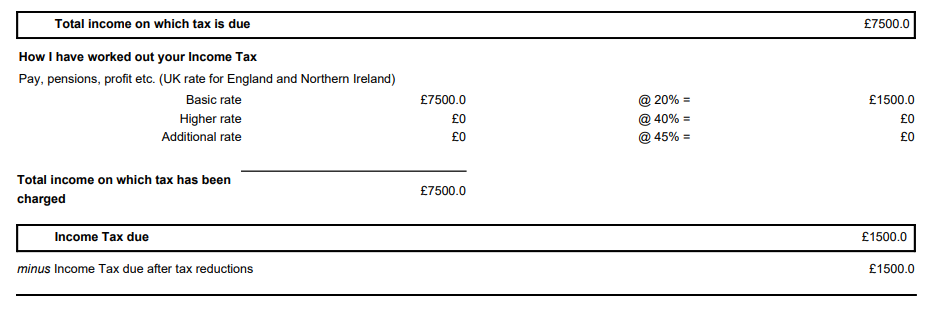

Income Tax

Income Tax for England is shown in this example, and is based on different percentages depending on the total amount of income above the personal allowance.

In this example, the balance of £7,500 from the previous section has been subject to basic rate tax, at 20%. This provides a taxable balance of £1,500.

Note: If you had any employment during the financial year, and had any tax deducted from your salary, this will then be deducted from the amount due to acknowledge that the payment has already been made through PAYE.

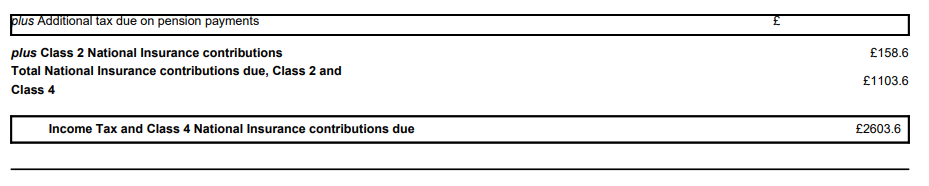

National Insurance

The next step is National Insurance. Class 2 is charged at a flat rate, and in this example it is shown as £158.60 for the financial year.

Class 4 is slightly different and is based on the amount we started with as our profit from self employment, which was £20,000. Just like with tax, there is an ‘allowance’ which is not subject to Class 4 NI and for 20/21 this was £9,500. As such, this is deducted from the £20,000, leaving £10,500 subject to National Insurance Class 4.

Class 4 is charged at 9% for the initial rate, therefore 9% of £10,500 is £945. In our system calculation from HMRC, this is added to the Class 2 value (158.60) to show a total of £1,103.60 National Insurance due.

The final row shows the total amounts which are now due to HMRC. These are:

- Class 2: £158.60

- Class 4: £945

- Tax: £1,500

- Total: £2,603.60

The total balance is usually due by 31 January in the year following the close of the tax year (so for 20/21 tax year, this is 31 January 2022).

Payments on Account (POA)

Where your tax bill is more than £1,000, you’ll be required by HMRC to make Payments on Account.

In our example above, the tax bill was more than this, therefore Payments on Account are due.

They’re usually 100% of your tax bill (including Class 4 NI, but excluding Class 2) and due in two halves – one by the 31 January deadline and the second 6 months later – by 31 July.

Continuing our example above would mean that the below payments on account would be due:

Total of tax (£1,500) and Class 4 NI (£945) = Payments on Account of £2,445

Split into two payments of £1,222.50 – due by 31 January and 31 July

As such, the amount due is now:

By 31 January: £2,603.60 tax + £1,222.50 Payments on Account = £3,826.10 due

By 31 July: £1,222.50 (remaining payment on account).

It’s easier to think of Payments on Account as pre-paying towards the next tax bill. From the above, the self employed individual would be in credit by £2,445 when they file their next tax return. This amount is then deducted against any tax or national insurance which is due. If your bills are lower the following year, HMRC can refund any residual balances they hold for you.