When you’ve completed your business accounts, and the end of the financial year approaches, our team will contact you to advise that it’s time to prepare your annual return.

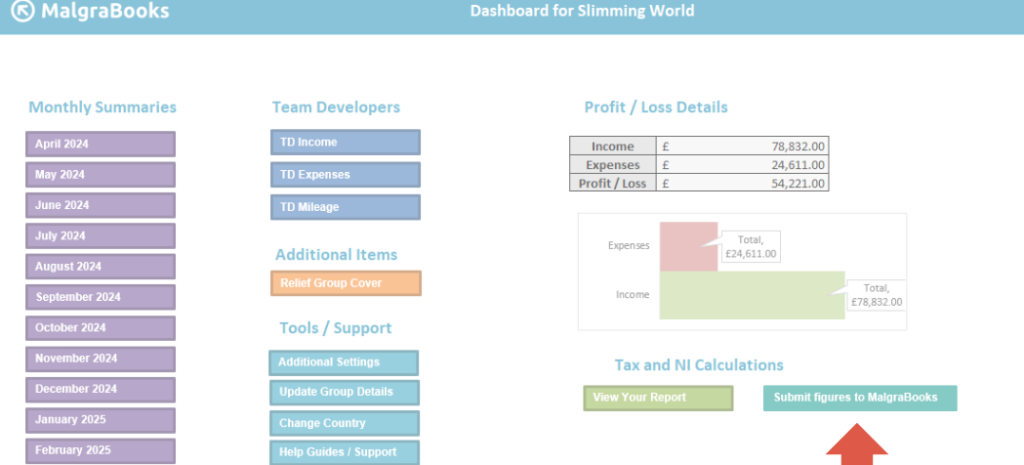

When ready, make any final checks to your data and then head to the Main Menu within your cloud accounts and select the ‘Submit figures to MalgraBooks’ button show below with the arrow.

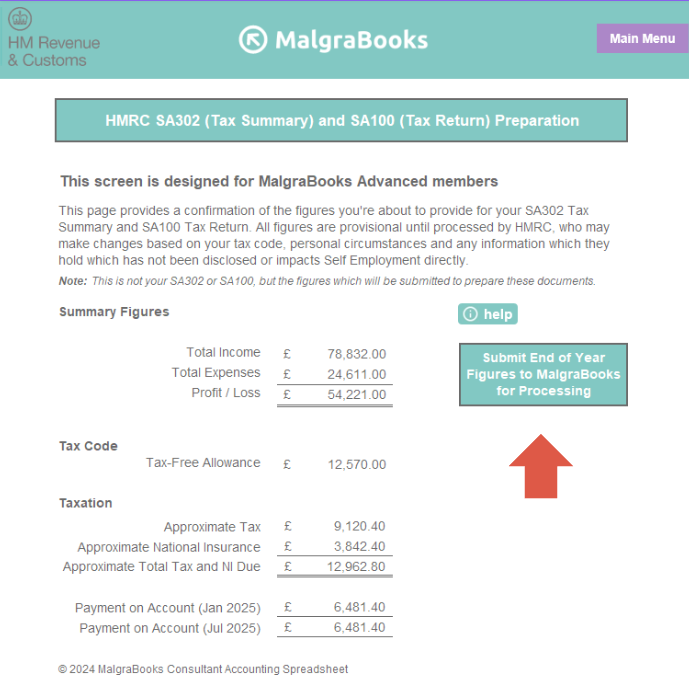

You’ll then be taken to the SA302/SA100 Preparation Screen – this shows a full breakdown of your current data which has been entered into the system.

If you need to make any changes, simply return to the relevant Monthly Summary page and update your data.

Once you’re happy that there’s nothing further to add for your Self Employment, click the ‘Submit End of Year Figures to MalgraBooks for Processing’ button to continue.

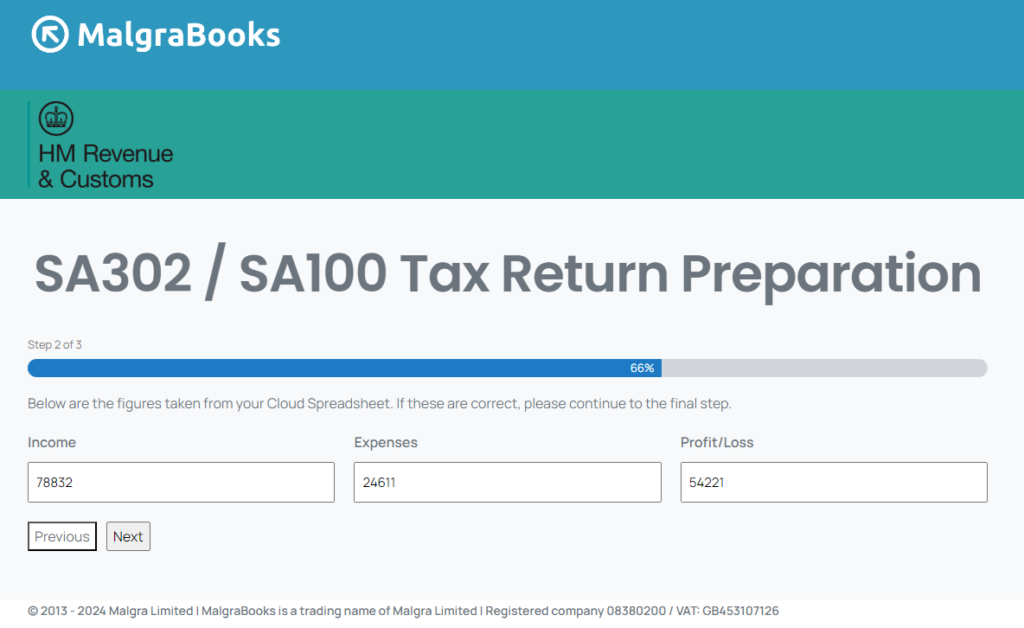

This will then take you through to your MalgraBooks Account to confirm the final information for your Tax Return. Once complete, the information will be submitted to our team for processing.

Once the steps have been completed online, your figures are submitted to our team for final checks to be completed, and preparation of your draft Tax Return.