The Virtual Group Account Viewer launched on 17 January 2021 is designed to provide an overview of the earnings from your Virtual Groups. The system currently goes back to w/c 6 December 2020, and updates are being planned to backdate the tool back to April 2020.

There are two main screen sections – the Financial Summary provides the information you need for your business accounts.

Example Calculations

When we talk about franchise fees, there are several main items which we consider when calculating the total income from your group – and the expenses paid out – before reaching the final profit. This is usually done by following the below calculation:

Nett Fees A + Retained Earnings + Rent Paid = Total Fees Taken

Obviously, rent is not something considered with virtual groups (although Zoom fees are!) – however the listing of items on the new Account Viewer is different to a traditional PFS. We’ve created an example below.

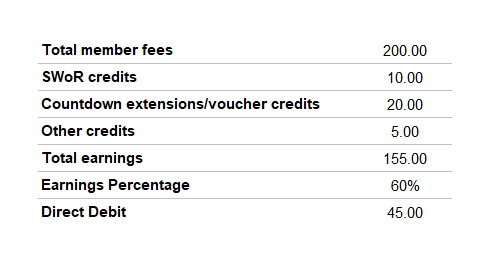

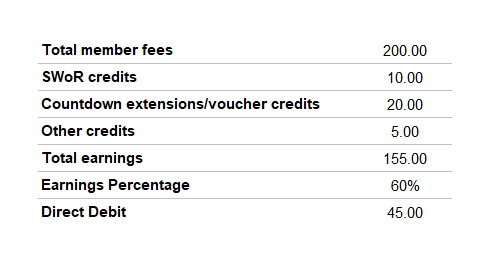

Here’s a breakdown of what the above summary is showing:

- Total member fees – this is the total amount of fees which have been received from members for the group. In this example, it’s £200

- SWoR credits – these are additional credits paid to the consultant. These would usually have been ‘sundries’

- Countdown extensions/voucher credits – these again are credits paid to the consultant, and would have been sundries

- Other credits – same as the above two items, but more of a ‘miscellaneous’ credit

- Total earnings – this is an amount Slimming World have calculated similar to ‘retained earnings’, however for the purposes of your business accounts, we’re going to ignore this value

- Earnings percentage – The percentage earnings applied to your account

- Direct Debit – The amount Slimming World have taken for your account, however again we’re going to ignore this value

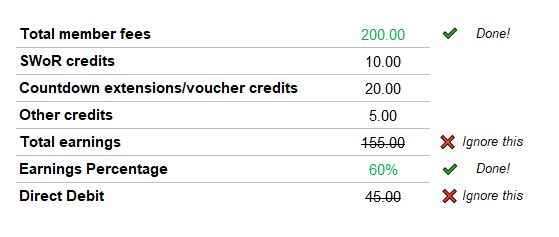

From the above summary, we’ve mentioned ignoring two values – this is because they are ‘calculations’ which have been made in the background, and can be ignored for the purposes of your spreadsheet. The other values are important.

First, we have the total member fees – this is income and is showing as £200. However we need to break this down into what is later taken as Net Fees A and what is ‘retained earnings’ for your spreadsheet.

To work out the split, look at the earnings percentage – in this example, it’s 60%. Therefore 60% of £200 is £120, and the remaining 40% is £80.

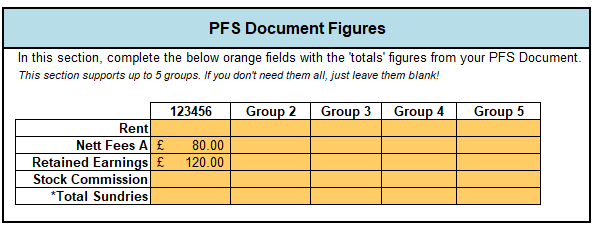

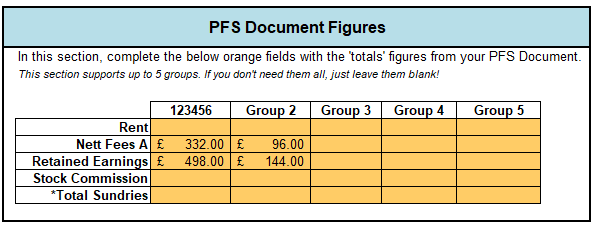

The larger split (60%) are retained earnings and the remainder (40%) are your Net Fees A. This can be entered onto the spreadsheet as shown below.

The spreadsheet will do the calculations in the background as usual.

Let’s now check back on the table and see what is left.

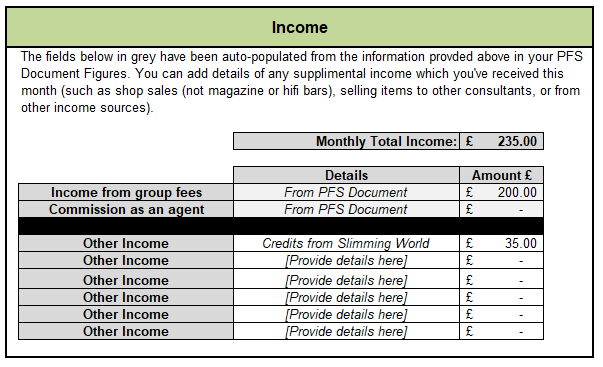

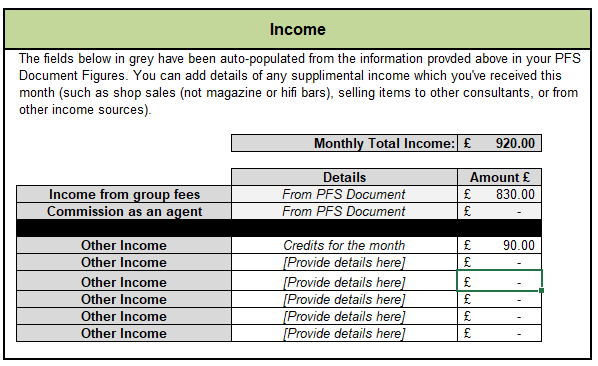

We now need to add up the credits which have been paid to the consultant from Slimming World. For these, we simply add the values together (£10 + £20 + £5) and add the total into the Income section of the spreadsheet as shown below.

And we’re done. Everything has been added into your spreadsheet for your virtual group, and accounted for within the system.

Next steps – Calculating Monthly

As mentioned above, this version of the Virtual Account Viewer works only on a weekly basis, whereas usual PFS documents run on a monthly basis. As such, we’ll need to do some more calculations to ensure everything is up to date.

There are two options, depending on your circumstance:

I only held virtual groups (so max 4 or 5 ‘weeks’ per month)

If you only held virtual groups during the month, you can ignore the ‘group numbers’ section within the PFS Document Figures section of your spreadsheet and add each week into the separate columns.

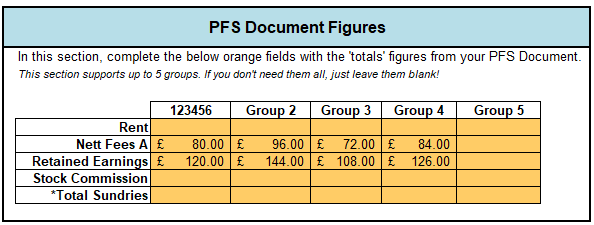

For example, if you held 4 groups during the month, you can add each individual weekly group into each separate column as shown below.

Adding groups in this way will calculate as normal, and doesn’t matter if you normally would have only entered 1 group’s data in the system.

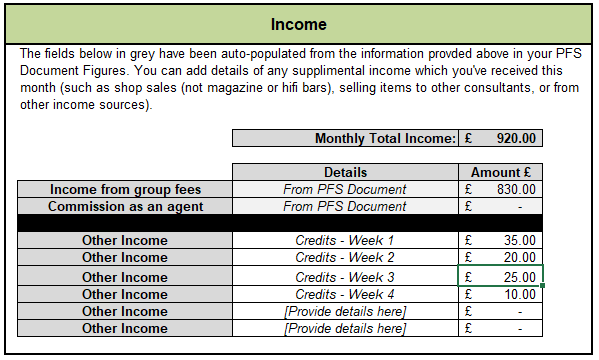

And any credits from the weeks can be added to the income section as below:

This will then balance accordingly.

I did both virtual groups and in-person groups

If you did a bit of both, depending on the number of groups you ran you may need to do a little bit of calculating so that it fits into your spreadsheet.

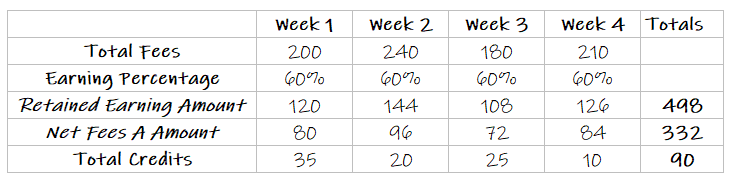

For example, let’s imagine we held 4 virtual groups this month and then 1 in-person group. First, we need to work out the figures as below from the Virtual Account Viewer summary.

You’ll need a pen and paper for this part, and possibly a calculator too for the percentages(!)

We’ve then worked out the total values in our ‘totals’ column – here we’ve three key values, our total Retained Earnings, total Net Fees A and Total Credits for the virtual groups.

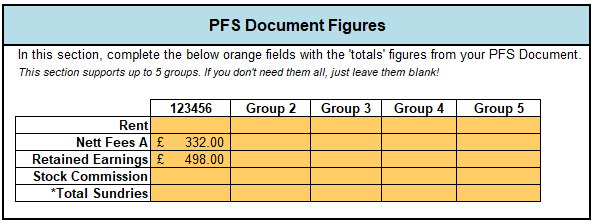

These can then be entered into Group 1 PFS as normal, shown below.

And the total credits into the Income section

For the group which we ran in-person, we can add the details from the Monthly PFS Document as we usually would, into any available column showing.

And we’re done!

What about that Direct Debit amount?

The reason we ignored this value previously is that it was a calculation and shouldn’t be used in either your income or expenses amount.

A common misconception is that the Direct Debit amount is an expense, and in usual circumstances these are – however Slimming World have carried out a calculation in the background to get to this figure.

From the original summary example, the percentage earnings was 60%. Therefore, 40% of £200 total member fees would be £80 and would be the Net Fees A amount paid to Slimming World.

However there are credits from Slimming World on this summary, totalling £35.

Instead of taking a direct debit amount for the Net Fees A amount (£80), and then also sending a payment to you of £35, Slimming World have worked out the difference from what you owe them, and what they owe you – therefore they’re only taking £45 on this example.