From the main menu of your cloud accounts spreadsheet, you can access your annual report to show the values you’ve entered and generate the relevant information you’ll need for your tax return.

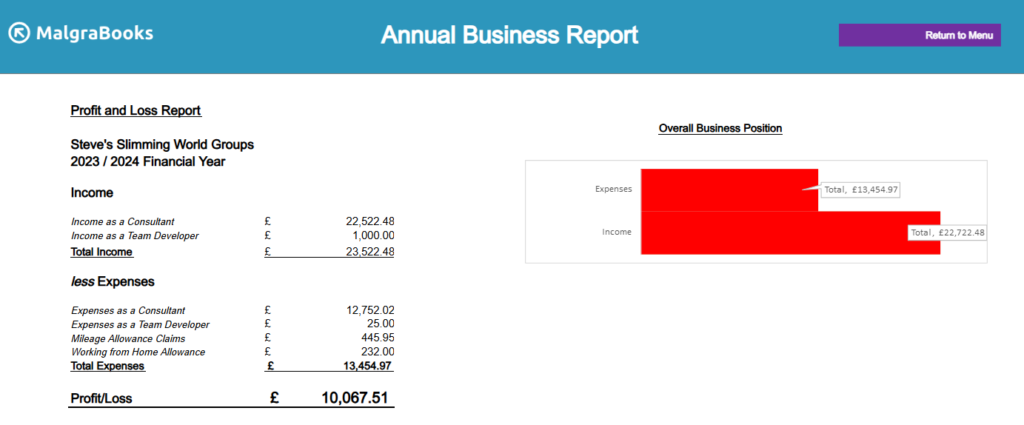

Profit and Loss Report

A very simple overview of your accounts is provided at the top of the report, showing all income and expenses which have been entered into the spreadsheet, along with the final Profit/Loss figure.

Underneath this section, the numbers are broken down further to explain where the overall values have come from.

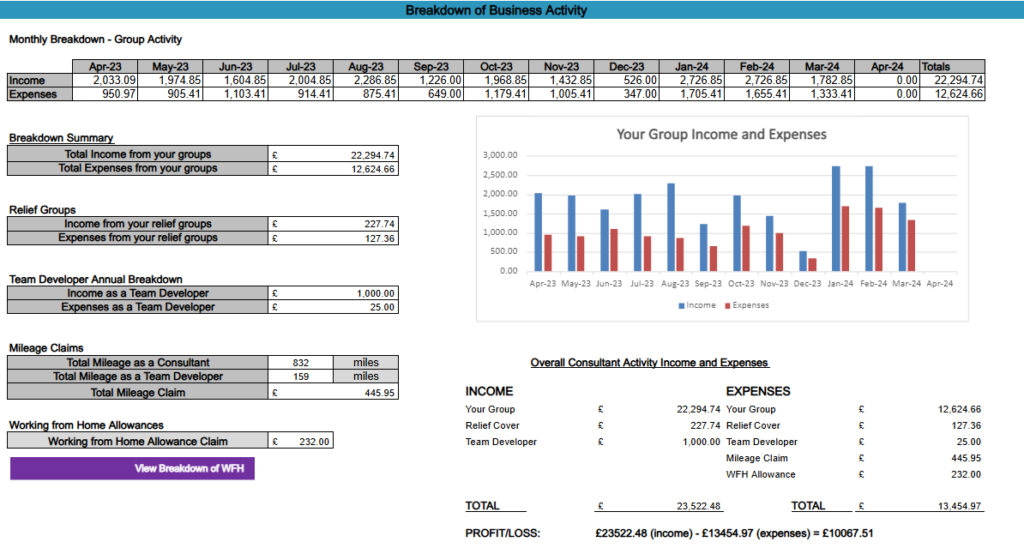

Business Activity

This section breaks down month by month the amount of income and expenses you’ve entered, along with breakdowns of data provided from the Relief Groups screens, Team Developer activity and also your Mileage Claim and Working from Home Allowances taken from the monthly data input.

A small chart showing where the income and expenses are through the year is provided, along with a larger breakdown of the previous profit and loss section.

Expenses Reporting

If you have used the categories to log your expenses, you’ll see a breakdown of what you bought below – identifying which are your largest spending categories.

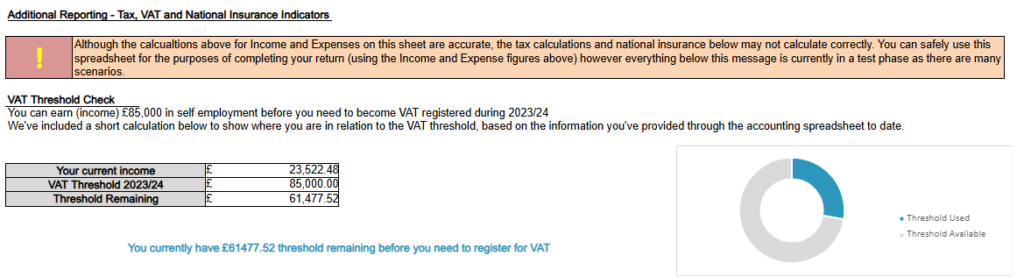

VAT Calculation – Financial Year

The system provides a brief overview of the Financial Year in relation to VAT.

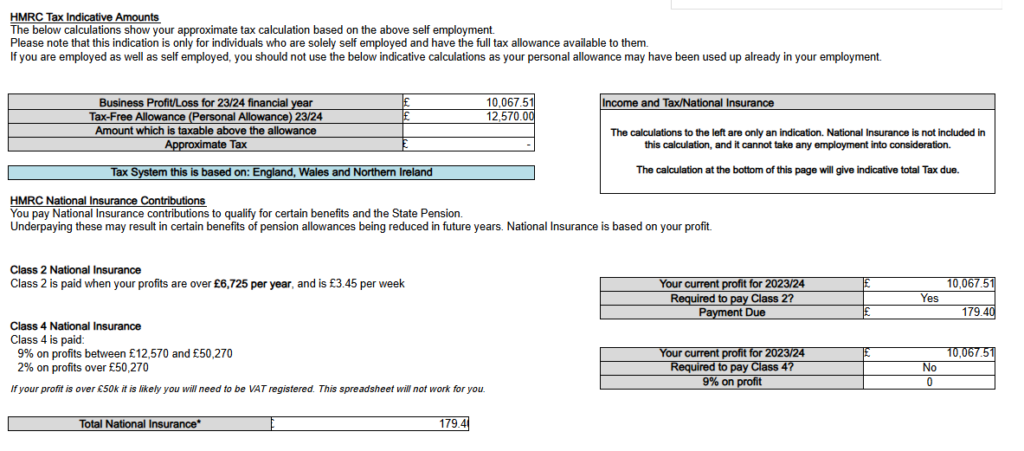

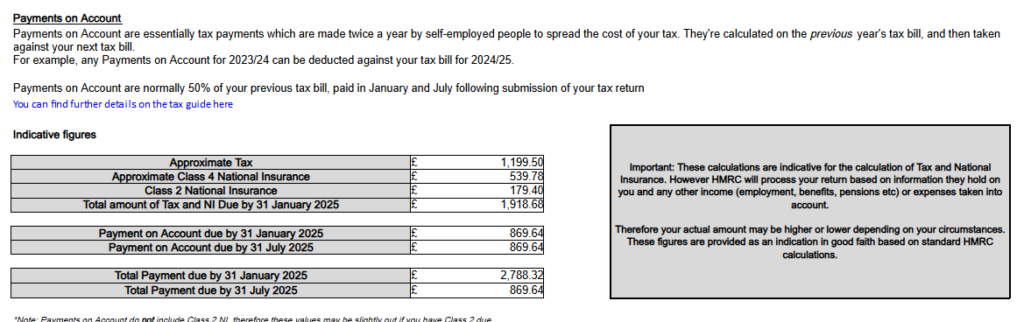

Indicative Tax Values

You can view a breakdown of current expected Tax and National Insurance in the next section. This will change each time you enter data into the system.

The main overview provides explanation of tax and your personal allowance. The system assumes that you have the full tax allowance available.

The system also shows any Class 2 or Class 4 National Insurance which may be due.

Payments on Account

The final section will provide details of any Payments on Account which may be due – especially if your tax value is above £1,000.