Our mileage tracker booklet is very popular since it was launched back in 2018 – the A5 booklet is designed to be kept in your personal vehicle to track your business mileage, to comply with HMRC regulations on claiming eligible mileage.

How to use

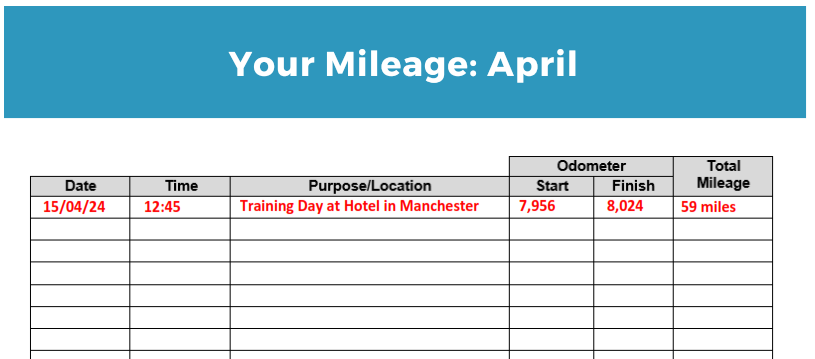

The booklet provides a simple table each month during the financial year to log your business mileage. There’s several headings, ready to be completed as required. An example below shows a business training session of 59 miles.

At the end of each month, there’s a Total column which can the be completed ready for use as part of your business accounts.

Where to provide the figures

The overall figures should then be replicated into your business accounts system

How long do I need to keep the booklet?

As required by HMRC, you’ll need to keep the booklet for 5 years after the 31 January deadline for the relevant financial year.

For example, for the 22/23 financial year, the deadline was 31 January 2024, and the record will need to be kept until at least January 2029.

You can also read about record keeping on our dedicated article.